LONDON, UK: Optical components & systems maker Gooch & Housego PLC (AIM: GHH) has agreed to buy thin-film coating specialist Artemis Optical Holdings Ltd (“Artemis”) for up to £8.9 million. The deal will boost G&H’s product range and allow it to integrate and sell its combined skills more effectively.

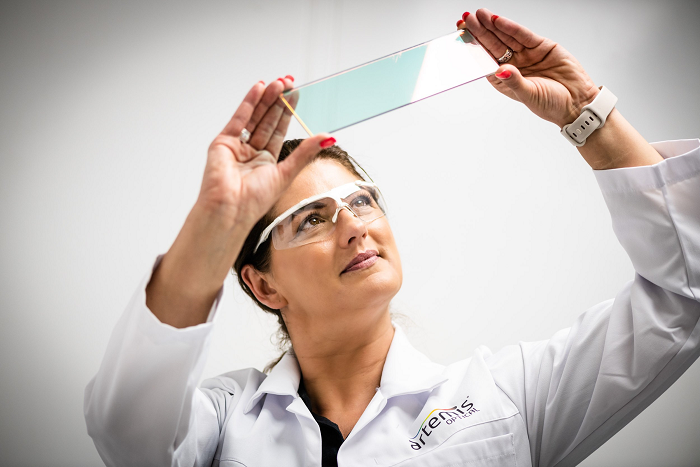

Artemis is known for its cutting-edge optical filters, mirrors and patches for various applications, such as electro-optical systems, laser protection, head-up displays and helmet mounted displays. It serves customers mainly in Aerospace & Defence, Industrial and Life Sciences markets.

Artemis is based near Plymouth in the UK and has around 40 staff. It will become a centre of excellence for developing new coatings across G&H and will complement the Group’s existing coating capabilities.

The deal is part of G&H’s new strategy to increase its margins by offering high-quality substrates and coating materials that match the needs of its customers. G&H will also help Artemis to reach new markets and customers with its resources, expertise and global presence.

Gooch & Housego CEO Charlie Peppiatt said: “Artemis’ thin-film coatings excellence adds to our skills and helps us deliver advanced photonics technology and great value for our customers. Together, we can speed up our innovation plans and make the world a better place with photonics.”

G&H will pay up to £8.9 million for Artemis. This includes an initial cash payment of £4.5 million, funded from existing resources, plus £2.4 million of new G&H ordinary shares, equivalent to 412,088 shares. There is also a deferred cash payment of up to £2.0 million, depending on Artemis’ performance in the next two years until 31 July 2025. The deal is expected to close on 21 July 2023.

In the year ending 31 March 2023 Artemis had revenue of about £4.3 million and adjusted EBITDA of about £0.7 million. At the end of June 2023 Artemis had gross assets of about £3 million.

The deal is expected to slightly increase G&H’s earnings in the first full financial year of ownership.

Kingspan acquires majority stake in Steico, the world leader in natural insulation

Leave a Reply