Know Your Customer using Blockchain

KYC (Know Your Customer) using Blockchain eliminates the repeated KYC checks that banks currently perform by maintaining a common secure database in a blockchain. The nature of a blockchain ensures that unauthorized changes to the data are automatically invalidated.

The proof of reputation concept makes the verification process more robust and secure. Decentralized computing architecture, blockchain will allow for the accumulation of data from multiple authoritative service provider into a single immutable, cryptographically secured and validated database.

According to IJTSRD, Blockchain KYC solution take advantages of a secure, public digital ledger to give almost instantaneous and truly secure verification of identity. Due to the immutable and unalterable nature of the record kept in the blockchain, fraud could become a thing of the past.

Know Your Customer (KYC)

KYC is an abbreviation for “Know Your Customer” and is a significant term utilized by organizations and alludes to the procedure of check of the character of the customers either previously or during the beginning of working with them.

The documents is put together by the client to an association so as to make trust between the two gatherings. At first, there was no real way to confirm the personality of the clients therefore KYC was proposed in the United States in 1990. Around then the reason for KYC was to stop fear monger financing and tax evasion through banks.

The fundamental partner of KYC is bank. Banks request that their clients fill KYC record with the goal that they can check their personality. Bank crosschecks the data put together by customers to stop tax evasion, psychological oppressor financing, and budgetary fakes. In this way, at present banks don’t permit any record holder without KYC documentation. KYC archive contains client data, ID confirmation, address verification, and photo. At first, the pen-paper approach was utilized for submitting KYC archive however the issue with support of records was noticeable.

The errands got furious for the bank to check the personality each time through paper filled by the clients. The odds of the record being lost were more in such case. In this way, computerized KYC framework was proposed, which is called e-KYC. In that approach, the client fills the KYC archive through the web utilization of the association. Information submitted were put away in brought together databases. Anytime, the association can get to the client data through client id.

This framework was paperless so by and large expense got decreased however since, information is put away in the brought together database along these lines, escape clauses of the incorporated framework like the single purpose of disappointment, information repetition and outsider inclusion in check despite everything exists. Likewise, information put away in the brought together server can be undermined or assaulted by the programmers in this way, odds of the hole of client private information is more in the current unified framework design. The objective of this paper is to propose a new approach to the KYC verification process. This process is very safer and faster than the other systems. Hence there is no need for further verification for other organisations.

The system is Ethereum based decentralized solution. Only hash value and username is stored as data on the blockchain. In most of the KYC systems, there is an option to upload documents such as ID proof, passport, address proof, etc. Therefore the system has all the functionalities of a traditional KYC system including image data is stored in the decentralized database.

Blockchain

Blockchain is truly only a chain of blocks, however not in the conventional feeling of those words. At the point when we state the words “blocks” and “chain” right now, are really discussing about digital data stored in an open database. This tech network has been discovered for the innovation with the potential purposes. A blockchain is, in the least complex of terms, a period stepped arrangement of immutable records of information that is overseen by a cluster of computers not possessed by a single element.

Every one of these blocks of information is made sure about and bound to each other using cryptographic standards. The blockchain network has no central authority. Since it is a common and immutable record, the data is open for anyone and everyone to see. Hence, anything that is based on the blockchain is by its very nature straightforward and everybody included is responsible for their activities. The blockchain is a straightforward yet cunning method for passing data from A to B in a completely computerized and safe way. One gathering to an exchange starts the procedure by making a blocks.

This blocks are checked by thousands, maybe a great many computers disseminated around the net. The verified blocks are added to a chain, which is put away over the net, making a novel record, however a remarkable record with an exceptional history. [1] 2.2. Smart contract A smart contract is a computer convention expected to carefully encourage, confirm, or authorize the exchange or execution of an agreement. Smart contract permit the exhibition of credible exchanges without outsiders. Probably the best thing about the blockchain is that, since it is a decentralized framework that exists between completely allowed parties, there’s no compelling reason to pay mediators (Middlemen) and it spares you time and struggle.

Blockchains have their issues, however they are appraised, verifiably, quicker, less expensive, and more secure than customary frameworks, which is the reason banks and governments are going to them. Smart contracts aid you with trading cash, property, offers, shares, or valuable documents in a straightforward, clash freeway while staying away from the administrations of an agent. The best approach to depict smart contracts is to contrast the innovation with a candy machine.

Usually, you would go to a legal advisor or a public accountant, pay them, and pause while you get the report. All the more in this way, smart contracts not just characterize the standards and punishments around an understanding similarly that a customary agreement does, yet additionally consequently uphold those commitments.

Ethereum

Ethereum is as of now the most generally utilized shrewd agreements improvement stage that can be seen as an exchange based state machine: it starts with a beginning states and gradually executes exchanges to transform it into some last states. It is the last states which we acknowledge as the accepted “rendition” in the realm of Ethereum.

Not at all like the UTXO model of Bitcoin, Ethereum presents the idea of accounts. There are two types of records: 1) remotely possessed accounts and 2) contract accounts. The thing that matters is that the previous is constrained by private keys without code related with them, while the last is constrained by their agreement code with related code. Clients can just start an exchange through an EOA.

The exchange can incorporate paired information (payload) and Ether. On the off chance that the beneficiary of an exchange is the zero-account, a keen contract is made. Or then again if the beneficiary is an agreement account, the record will be actuated and its related code is executed in the nearby EVM (the payload is given as information). The exchange is then communicated to the blockchain arrange where excavators will check it.

So as to keep away from issues of system misuse and to evade the unavoidable issues coming from Turing culmination, every programmable calculation (e.g., making contracts, making message calls, using and getting to account stockpiling, what’s more, executing tasks in the virtual machine) in Ethereum is liable to expenses a prize for diggers who contribute their processing assets. The unit used to gauge the expenses required for the calculations is called gas.

CURRENT KYC PROCESS

Financial organizations are bound by regulators to onboard their customers before conducting any activity with them, in order to avoid working with customers that pursue either of the aforementioned illicit activities.

The KYC process consists of an exchange of documents between the clients and the financial institution that intend to work together. The process has the collection of basic identity information from all beneficiaries to check for illegitimate activity and politically exposed persons.

The process also includes risk management with regard to onboarding new customers, the monitoring of transactions, and specific customer policies for banks. The process is costly for financial institutions and may expose them to large fines if it is not conducted in accordance with the existing regulations.

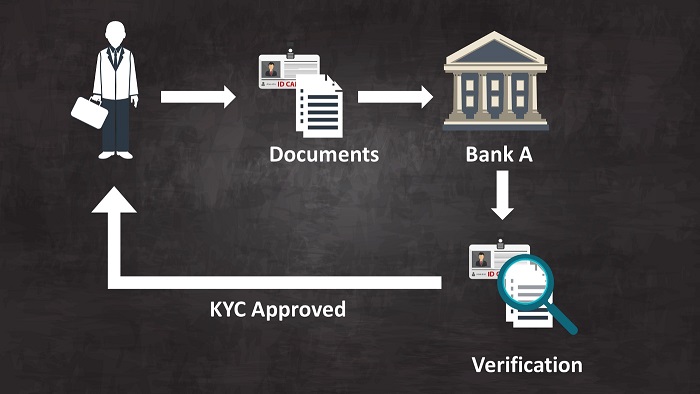

The KYC process is initiated when a customer intends to work with a financial institution. Consecutively, the customer and the financial institution agree on the terms of a relationship. Then, the customer sends the required documents to the financial institution in order to enable the institution to conduct the KYC verification process.

The financial organizations analyzes the documents and generates an further, internal document that serves as the certification that assures regulators that this customer has been either validated or rejected and that the KYC process has been properly conducted. This process is repeated every time the customer intends to work with a new financial institution.

In the current setting, every time a customer initiates a relationship with a financial organization the costs of the KYC verification process reoccur. This example case shows how, for this single client, the exchange of documents and the core KYC validation must be take on three times, such that the total costs that are generated by this clients are three times those of a single KYC process.

At this point, it is supreme to differentiate between the “core KYC verification process”, which is the minimum KYC verification that all financial institutions are obliged by law to conduct, and additional, bank specific processes. While further documentation can be asked for by each financial organizations to create an “additional aura of information” for every client, our solution focuses merely on the core KYC verification process, which is that shared by all the financial institutions in a jurisdiction.

Blockchain’s immutable ledger that is appropriated more than a large number of gadgets over the world is an ideal supplement to the obscure procedure of KYC that is being utilized everywhere throughout the world at this moment. With the expansion of smart contracts, a ton of the scam detection that depends on people right currently can be computerized.

Robotizing these procedures makes them less inclined to mistakes as well as recoveries a ton of overheads in time and cash. For KYC document storage, it bodes well for the banks to build up a common private blockchain, like the one being utilized by Civic. In the wake of onboarding a customer once, a similar data can be utilized later on by different foundations without burning through cash on confirming the records indeed. Like Civic, whenever a foundation solicitation to see the information, the client would get a brief on their own gadget asking to either permit or deny the solicitation.

This permits clients to deal with their delicate archives and furthermore makes it simpler for banks to acquire the reports they requirement for consistence.

CONCLUSION

Blockchain innovation is an emerging solution for decentralized transactions and data management without the need of a trusted third party. The Proposed system is a proper swap for inheritance KYC system. Also it provides all the necessary features of a legacy KYC system. The decentralized engineering likewise benefits the clients as far as security, ease of use, and trust.

Everything from the immutable nature of blockchain to their capacity to help improve transparency in client ID will hugely help improve the procedure and reduce fraud. Government bodies will also benefit as risk officers will have better access to data so the relationship between the financial sectors and regulators will be more transparent. This provides the provision for a massive reduction of financial fraud and crimes in the long term.

Effective usage of the Blockchain KYC can improve the degree of security and protection. The immutable and decentralized ledger allows third parties to validate the user’s data without wasting time and money.