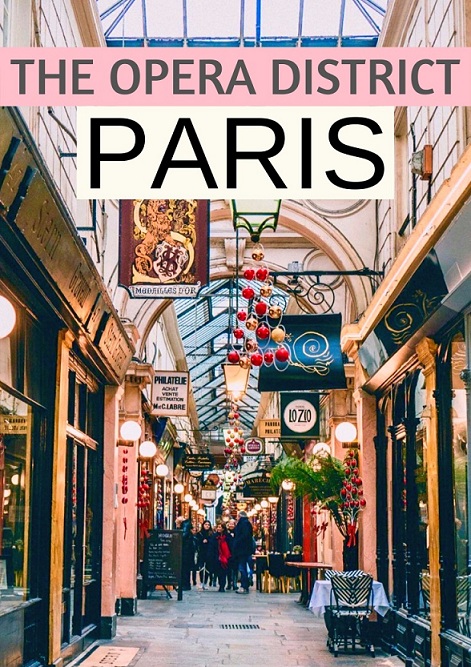

BRUSSELS: Pictet Alternative Advisors and Immobel have acquired 4,500 sqm office property located in the Paris-Opera district, in an off-market transaction.

The asset, located at 73 Rue de Richelieu in the 2nd arrondissement, currently sits fully vacant after the previous long-term tenant vacated its premises in 2020 offering a significant redevelopment opportunity in one of Paris’s most sought after locations.

Pictet and Immobel aim to deliver a Grade A office building and achieve multiple targets across different dimensions of the ESG spectrum.

The asset comprises seven above ground floors as well as a multi-storey underground car park with 100 spaces. Post redevelopment the building will be suitable for multi as well as single tenant uses.

Alexis Prevot, Chief Investment Officer Immobel Group, commented: “We are very excited about this joint-venture with Pictet Alternative Advisors and are proud to have them as a partner and investor in this strategically located asset.

The Richelieu project fits our ambitions in the field of real estate investment management, and we are confident that our vision for the office of the future enhanced with our focus on sustainable real estate, can make this a top-class office development for gateway city Paris.”

Charlie Baigler, Head of Acquisitions Pictet Alternative Advisors, added: “This acquisition is in line with the Elevation Fund’s strategy to create core assets in gateway cities through active asset management with best in class operating partners. The central Paris office market has proven to be extremely resilient and the supply and demand fundamentals remain attractive.

We believe office buildings will be more differentiated to attract employees back, with good environmental credentials becoming ever more important. The quality of the location of the asset offers strong downside protection against potential market volatility. Our partnership with Immobel ensures the highest development standards with a strong focus on ESG.”

Immobel is the largest listed real estate developer in Belgium. The Group, which dates back to 1863, creates high-quality, future-proof urban environments with a positive impact on the way people live, work and play, and specialises in mixed real estate.

With a stock market valuation of over EUR 650 million and a portfolio of more than 1,600,000 m² of project development in 6 countries (Belgium, Grand Duchy of Luxembourg, Poland, France, Spain, Germany), Immobel occupies a leading position in the European real estate landscape. The Group strives for sustainability in urban development. Furthermore, it uses part of its profits to support good causes in the areas of health, culture and social inclusion. Approximately 200 people work at Immobel. www.immobelgroup.com

Leave a Reply