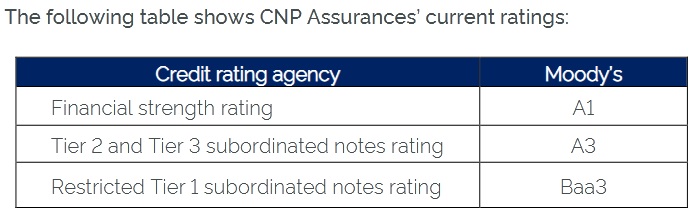

PARIS: Credit rating agency Moody’s has affirmed its financial strength and subordinated notes ratings for CNP Assurances despite the unprecedented health and financial crisis.

As previously, the A1 financial strength rating (with stable outlook) for the Group does not include any specific uplift linked to CNP Assurances’ shareholding structure.

In its press release published on Friday, Moody’s underlined CNP Assurances’ “the group’s strong market position, supported by long-term exclusive distribution agreements with its main banking partners, and a limited liability riskprofile, evidenced by a low average guaranteed rate on its French life products”.

“This latest credit rating by a leading agency once again reflects CNP Assurances’ excellent credit quality and strength despite today’s particularly difficult health, economic and financial backdrop,” said Antoine Lissowski, Chief Executive Officer of CNP Assurances.

A benchmark player in the French personal insurance market, CNP Assurances is active in 19 countries in Europe and Latin America, with a significant presence in Brazil, its second largest market. Acting as an insurer, co-insurer and reinsurer, CNP Assurances develops innovative personal risk/protection and savings/pensions solutions.

It has more than 36 million personal risk/protection insured worldwide and more than 12 million savings/pensions policyholders. In line with its business model, the Group’s solutions are distributed by multiple partners. The solutions are aligned with each partner’s physical or digital distribution model, while also being tailored to local clients’ needs in each country.

CNP Assurances has been listed on the Paris Stock Exchange since October 1998. The Group reported net profit of €1,350million in 2020.