Ricardo Plc announces sale of defense business for $85 million

LONDON: Ricardo Plc has announced the conditional sale of its Ricardo Defense Business to Proteus Enterprises LLC and Gladstone Investment Corporation, through GPD Acquisition Inc., for $85 million. The decision follows a thorough process by Ricardo’s Board.

Key Points:

Ricardo Defense is being sold to Proteus and Gladstone for $85 million. This figure is adjusted post-closing on a cash-free, debt-free basis.

This sale supports Ricardo’s five-year strategy, helping the company transition to a high-growth, high-margin, and less capital-intensive business.

Separately, Ricardo has announced the acquisition of an 85% shareholding in E3 Advisory for AUD $101.4 million, with the remaining 15% to be acquired after three years.

The sale of Ricardo Defense is expected to slightly reduce the Group’s earnings per share in the near term. However, this will be partly offset by earnings from E3 Advisory.

Graham Ritchie, CEO of Ricardo, said the sale is part of the company’s strategy to optimize its portfolio and focus on environmental and energy transition solutions. “Ricardo Defense has a successful history with the US Army, and we believe it will continue to thrive under new ownership,” Ritchie said.

With the sale of Ricardo Defense and the acquisition of E3 Advisory, Ricardo is now more focused on creating value in the medium to long term across its chosen markets.

Strategic Rationale:

Ricardo aims to position itself as an environmental, engineering, and strategic consultancy that supports global sustainability agendas. The company’s investments are focused on expanding its Environmental and Energy Transition portfolio, which aligns with its long-term sustainable growth strategy.

The Ricardo Defense Business, part of the Group’s Established Mobility portfolio, provides engineering and production services for land vehicles in the defense sector. The Board believes that now is the optimal time to maximize the value of Ricardo Defense through a sale.

Transaction Details:

The buyer will pay $85 million for Ricardo Defense, adjusted for working capital, indebtedness, and related costs. The sale involves all issued and outstanding stock of Ricardo US Holdings Inc., a subsidiary of Ricardo Group.

About Ricardo Defense:

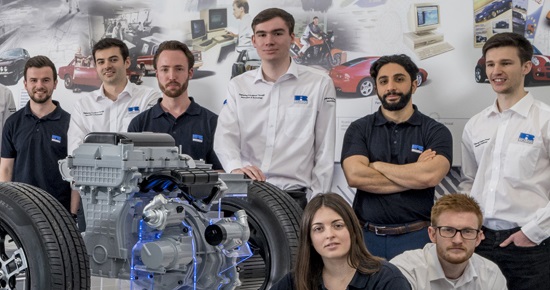

Ricardo Defense provides engineering, software, and logistics solutions to the U.S. Department of Defense and contractors. Headquartered in Troy, Michigan, it employs around 240 people, primarily in the U.S.

Next Steps:

The completion of the sale is expected to take place in December 2024, pending the fulfillment of outlined terms.