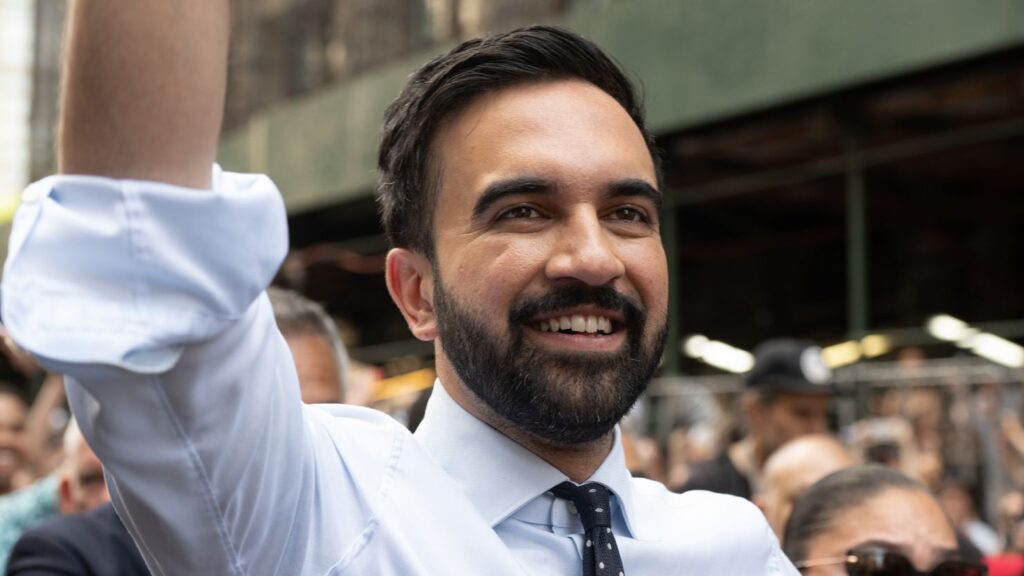

Zohran Mamdani’s NYC Win Signals Progressive Economic Shift with National Implications

Zohran Mamdani is a prominent figure in New York’s progressive left, and his election would represent a seismic shift in the city’s—and potentially the country’s—political and economic landscape.

Here’s a detailed breakdown of how the election of Zohran Mamdani as Mayor of New York City would likely impact the business and investment scene, both in the city and across the USA.

The Positive Case: A Reimagined Economy for New York

From this perspective, the goal isn’t to maximize corporate profits or luxury real estate values. It’s to build a more equitable, stable, and resilient city that works for the majority of its residents. Here’s what that could look like:

1. A Boon for Small and Local Businesses:

- Leveling the Playing Field: While large corporations would face higher taxes, small and local businesses, which are often squeezed out by chains and high rents, could receive significant support. Policies like commercial rent stabilization could be the lifeline that allows a local bookstore or restaurant to survive.

- Increased Consumer Base: When you raise the minimum wage and provide universal public goods like social housing, childcare, and healthcare, you put more disposable income directly into the hands of low and middle-income New Yorkers. These residents spend that money locally—at grocery stores, coffee shops, and movie theaters. This creates a virtuous cycle that supports Main Street businesses, not just Wall Street bonuses.

2. Long-Term Stability Over Short-Term Speculation:

- Taming the Housing Crisis: The current model of relying on for-profit developers has failed to create affordable housing. By prioritizing social housing and universal rent control, the city could provide stable, predictable housing costs. This reduces the massive financial strain on workers and families, making them more financially secure and productive. For businesses, this means a more stable workforce with lower turnover.

- Investing in Human Infrastructure: Massive public investment in the MTA, CUNY, and public schools is not an expense; it’s an investment. A better-educated, more efficiently transported workforce is a more productive and innovative workforce. This creates a superior long-term foundation for economic growth than tax cuts for corporations.

3. Leading the “Well-Being Economy”:

- A New Model for America: New York could position itself as a global leader in the “well-being economy,” which prioritizes health, sustainability, and equity over pure GDP growth. This could attract a new wave of “purpose-driven” businesses, social enterprises, and B-Corps, becoming a hub for ethical innovation.

- Tourism and Brand Identity: A cleaner, safer (through social means, not just policing), and more equitable city with vibrant public spaces and thriving arts (supported by public funding) could become an even more attractive destination for a certain segment of tourism and new residents who value quality of life over low taxes.

4. Correcting a Dysfunctional System:

- The “Amazon HQ2” Example: Supporters would argue that the old model of offering massive corporate tax breaks (like the failed Amazon HQ2 deal) is a race to the bottom. It gives public money to the world’s richest companies without guaranteeing community benefits. A Mamdani administration would end this, arguing that public money should be used for public goods, not private profit.

So, is the picture negative? It depends entirely on your definition of “good for business.”

- If “good for business” means: maximizing short-term stock prices, luxury condo development, and corporate profit margins, then yes, the outlook is decidedly negative.

- If “good for business” means: creating a stable, equitable city with a empowered consumer base, robust public infrastructure, and a thriving ecosystem for small and local enterprises, then the outlook is potentially positive, albeit through a period of turbulent transition.

Overall Outlook: High Uncertainty and Significant Risk

The immediate and overwhelming reaction from the majority of the business and investment community would be one of extreme caution and likely negative sentiment. Mamdani is a member of the Democratic Socialists of America (DSA) and his policy platform is explicitly anti-corporate and pro-worker in a way that is far more radical than any mayor in New York’s modern history.

1. Impact on the New York City Business Scene

Likely Negative Impacts (From a Business Perspective):

- Increased Regulation and Costs:

- “Good Cause” Eviction & Commercial Rent Stabilization: Proposals to control commercial rents would be devastating for property owners and landlords, making real estate investment far less attractive. For small businesses, it could be a double-edged sword, providing stability but potentially stifling new development.

- Stricter Labor Laws: A dramatic increase in the minimum wage, mandatory paid vacation, and powerful new unionization drives would significantly raise operational costs for businesses of all sizes.

- New Taxes and Fees: Proposals for a “Wall Street Tax” (financial transaction tax), a “Pied-à-Terre” tax on luxury second homes, and significantly higher taxes on large corporations and high-income earners would be pursued aggressively.

- Chilling Effect on Real Estate Development:

- Mamdani is a strong proponent of universal rent control and building social housing over market-rate developments. This would likely cause a sharp decline in private real estate investment and construction, exacerbating the housing shortage in the long run, even if it protects existing tenants in the short term.

- Criminal Justice and Public Safety Concerns:

- His platform includes defunding the NYPD and reallocating funds to social services. Regardless of the merits, the business community’s perception would be that this could lead to an increase in crime and disorder, which negatively impacts retail, tourism, and office attendance. A perception of less safe streets is bad for business.

- Hostile Relationship with Key Industries:

- Finance: A “Wall Street Tax” would be seen as a direct attack on NYC’s largest economic engine. Many financial firms would openly explore relocating operations to lower-tax jurisdictions like Florida, Connecticut, or New Jersey.

- Real Estate: The industry would be in direct opposition to the mayor, leading to legislative gridlock and a halt to many public-private partnerships.

- Big Tech & Large Corporations: His anti-corporate stance would discourage large tech companies and other corporations from expanding their NYC footprint.

Potential Positive Impacts (or Mitigating Factors):

- Boost to “Socially Conscious” and Local Business: Businesses that align with his values (e.g., co-ops, unionized workplaces, local manufacturers) might find a more favorable environment with new support programs.

- Increased Consumer Spending Power: If policies like a higher minimum wage and “Social Housing” succeed in putting more disposable income in the hands of low and middle-income New Yorkers, that money would be spent locally, benefiting small businesses and the service sector.

- Investment in Public Goods: Massive investment in public transit, schools, and green infrastructure could, over the very long term, create a more equitable and potentially more resilient city, which is a foundation for stable economic growth.

2. Impact on the National US Business and Investment Scene

The impact would extend far beyond the five boroughs, sending shockwaves through the national economy.

- A National Political Shockwave: Mamdani’s election would be interpreted as the most significant victory for the socialist left in modern American history. It would:

- Embolden Progressive Movements: Similar policies would be pushed in other major cities like Chicago, Los Angeles, and San Francisco. Businesses would have to prepare for a more aggressive regulatory environment in multiple urban centers, not just NYC.

- Deepen Political Polarization: It would become a central talking point in national politics. Conservatives would use it as evidence of the Democratic Party’s “leftward lurch,” impacting federal policy debates and elections.

- Capital Flight and Market Volatility:

- The mere proposal of a federal financial transaction tax (a national version of his “Wall Street Tax”) would cause significant volatility in stock markets.

- New York-based financial institutions would accelerate plans to move personnel and assets to more business-friendly states. This would represent a major redistribution of capital and high-paying jobs within the USA.

- The “Canary in the Coal Mine” Effect: New York is often a policy laboratory for the nation. Businesses and investors across the country would watch the NYC experiment closely.

- If it’s perceived as a failure (e.g., rising crime, budget deficits, corporate exodus), it would serve as a powerful deterrent to similar policies elsewhere.

- If it’s perceived as a success in creating a more equitable city without economic collapse, it would fundamentally shift the Overton window of what is considered possible in American urban policy.

Summary: The Most Likely Outcomes

- Immediate Capital Flight: A sharp, initial outflow of investment from NYC real estate and financial markets.

- “Wait-and-See” Freeze: Many businesses would freeze expansion plans in NYC, leading to stalled job growth.

- Budgetary Crisis: Confrontations with wealthy individuals and corporations would likely lead to a sharp decrease in tax revenues, potentially creating a massive budget shortfall that could threaten city services.

- National Polarization: The election would become a symbol of the struggle between capital and labor, with intense national focus on NYC’s every success and failure.