Epassi Group, a Nordic leader in digital employee benefits payments, has sold a majority stake to two global private equity firms, TA Associates and Warburg Pincus, for an undisclosed amount.

The deal will support Epassi’s vision to become the leading digital, pan-European employee benefits provider.

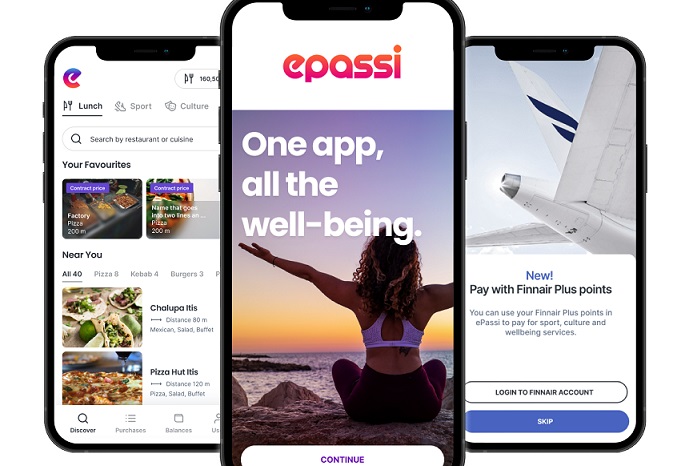

Epassi, founded in 2007, offers a range of employee benefits through its mobile-based platform, such as lunch, sports, culture, wellness and commuting.

The company serves about 10,000 employers and two million employees in Finland and Sweden, and has recently expanded into Italy, the UK and Ireland.

Epassi has grown rapidly in the past few years, increasing its gross merchandise value (GMV) by nine times, its number of customers by four times and its number of employees by five times since 2019.

The company’s previous majority shareholder, Bregal Milestone, a technology growth private equity firm, helped Epassi cement its leadership position in the Nordics and establish a strong foundation for future pan-European expansion. Epassi’s founder Risto Virkkala will remain invested in the next stage of the company’s growth strategy.

TA Associates and Warburg Pincus are two leading global private equity firms focused on growth investing. They have extensive experience and expertise in the technology and payments sectors. They will partner with Epassi’s management team to expand its product portfolio, customer base and geographic presence, both organically and through acquisitions.

The new investors said they are thrilled to support Epassi on its future growth journey, with a vision to expand its role as a pan-European leader in digital employee benefits solutions. They also praised Epassi’s commitment to innovation and its understanding of the evolving market needs.

Epassi’s CEO Pekka Rantala said he is proud to welcome the support of TA Associates and Warburg Pincus, two world-class growth investors, as he aims to expand into other business areas and markets. He also thanked Bregal Milestone for their help in showing the potential that Epassi possesses.

The deal is expected to close in the fourth quarter of 2023.

Hg and TA Associates make further investment in The Access Group

Apax X Fund and Warburg Pincus to jointly acquire T-Mobile Netherlands