Sampo plc to acquire full ownership in Hastings for GBP 685mn

LONDON, UK: Sampo plc has signed an agreement with Rand Merchant Investment Holdings Limited (RMI) to acquire its ownership in Hastings.

Under the terms of the agreement, Sampo will pay GBP 685 million for RMI’s 30 per cent minority interest in Hastings and the option held by RMI to acquire 10 per cent of Hastings’ share capital from Sampo by May 2022.

The transaction is expected to be completed later today, on payment of the purchase consideration to RMI.

Combined with the initial acquisition in November 2020, the agreement implies that Sampo will pay a total of GBP 1,851 million for 100 per cent of the share capital in Hastings, which equates to 278 pence per share. Based on consensus estimates for 2022*, this implies a valuation of 14x earnings and earnings accretion of approximately 4 per cent.

The value of the minority and option (GBP 685 million) equates to approximately EUR 806 million, which will be funded through internal cash resources. The acquisition is estimated to have a negative 14 percentage points impact on Sampo’s Solvency II ratio and to increase financial leverage by approximately 1 percentage point. The ongoing EUR 750 million buyback programme and the management proposal for an extra dividend of at least EUR 2.00 per share will not be affected by the transaction.

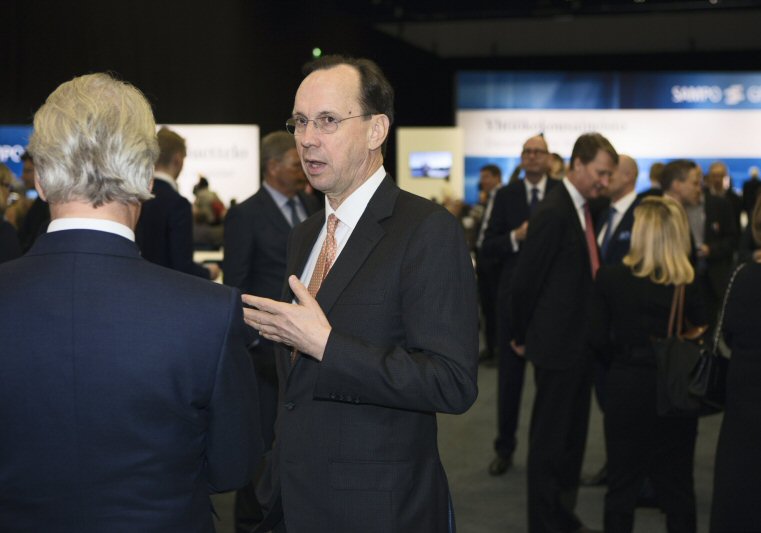

“Since completing the acquisition of Hastings in November 2020, I have been ever more impressed by the high quality of its operations and personnel. I am delighted that we have had the opportunity to take our ownership to 100 per cent,” says Torbjörn Magnusson, CEO and President, Sampo Group

“As the sole owner of Hastings, Sampo will gain full control of strategy, governance and capital management, enabling more agile decision making and frictionless knowledge sharing with If P&C. I look forward to working even closer with Hastings to execute on its strategic initiatives and capitalising on its strong position in the digital UK P&C insurance market, Magnusson continues”.

Goldman Sachs International has acted as financial advisor to Sampo plc in connection with this transaction.

Sampo Group is a significant Nordic insurance group made up of the parent company Sampo plc, If P&C Insurance Holding Ltd, Mandatum Holding Ltd, Danish insurer Topdanmark and British P&C insurer Hastings, all of which are its subsidiaries. The parent company in Helsinki administers the subsidiaries.