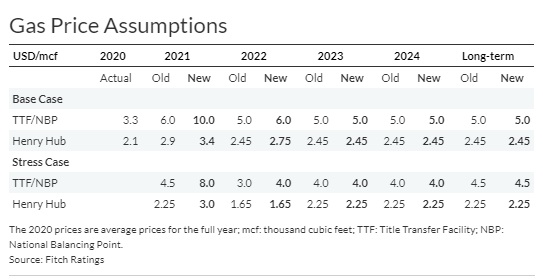

LONDON: Given the recovering demand and supply challenges as well as strong year-to-date prices, Fitch has revised upwards the natural gas price assumptions for 2021 and 2022.

The most significant increases are to European Title Transfer Facility (TTF) gas price assumptions. The current record-high spot prices are driven by extreme weather conditions this year, low gas inventories in storage, strong demand in Asia, recovering demand in Europe and insufficient additional supplies.

European spot prices have been closely correlated with those in East Asia as supplies of liquefied natural gas (LNG) to Europe have reduced since 2020, and both regions are competing for available LNG cargoes.

European storage inventories are significantly below the levels of end-August 2019 and 2020, despite Gazprom’s nearly record gas export volumes in January-August 2021 (up by 19%, all exports to non-former Soviet Union countries).

“We expect some of these challenges to spill over into 2022, and, therefore, have also increased our 2022 price assumptions. Still, the 2022 price assumptions are well below the 2021 levels as we expect weather conditions to normalise and Gazprom to increase its exports slightly,” Fitch Ratings said.

US gas prices have also benefited from heightened weather-driven demand, as well as US dry and associated gas production discipline.

LNG and Mexico export demand also remains strong in the US. Inventory is about 174 billion cubic feet below the five-year average as a result.

“We believe these factors will support pricing over the next 12-18 months, but expect a normalisation of demand and potentially weaker producer discipline to result in a return to mid-cycle pricing in 2023 and thereafter,” Fitch said.