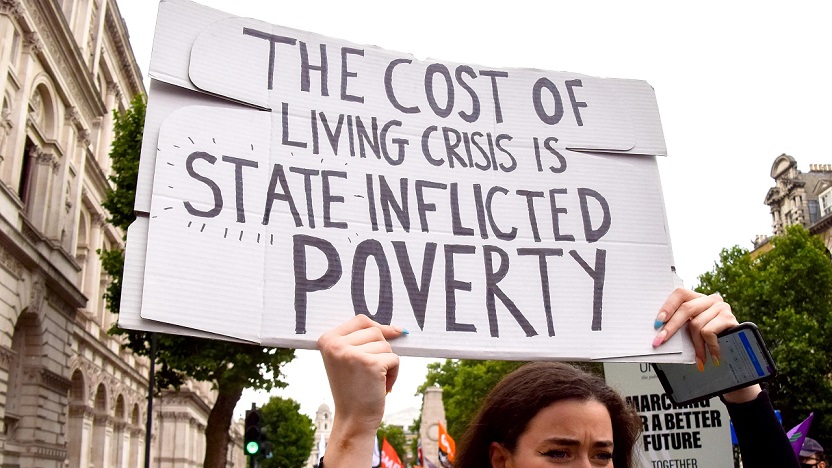

LONDON, UK: According to a renowned thinktank, Resolution Foundation, UK households are only halfway through a two-year cost of living crisis, and average salaries are set to drop by more than £2,000 as a result.

The cost of living crisis which, when combined with a tough recession, will leave households worse off than they were before the pandemic, a new report out today reveals.

The warning comes amid a rash of strikes by workers demanding pay rises closer to the average inflation rate of 10.7%.

A vote by teachers is expected to back strike action when the ballot results are announced over the next fortnight, adding more than 500,000 public sector workers to a tally that includes nurses, Whitehall civil servants and Border Force staff.

The thinktank said that while the headline rate of inflation was likely to fall over the coming months in response to tumbling international gas and petrol prices, the cost of living would still remain cripplingly high for many households.

Energy bills are expected to increase after “the slimming down of government support”, pushing the typical energy bill to rise from £2,000 in 2022-23 to £2,850 in 2023-24.

The drop in the cost of wholesale gas is likely to reduce the cost to the Treasury of government energy subsidies directed at businesses and households, but longer-term contracts covering the supply of gas to households are expected to keep retail prices high for at least the rest of the year.

A freeze on income tax thresholds will also increase tax bills for a middle-income household by around £700 from April, while rising mortgage costs will lead to a 12% fall in real incomes over a two-year period for the 3m households forced to refinance their mortgage loans.

Middle income and poorer households’ financial wealth tends to lower than richer families, meaning they are set to shoulder a relatively bigger hit from the cost of living crisis.

Rishi Sunak and Chancellor Jeremy Hunt’s £55bn worth of tax hikes and spending cuts last November will leave average Brits’ poorer, as will the government’s rolling back of energy bill support from April and higher mortgage rates.

But, the government signing off on a series of one-off payments to poorer families, uprating benefits by over 10 per cent and the energy bill price cap has averted a living standards catastrophe, the report said.

Child poverty rates are likely to increase markedly in 2023 as a result of those factors, the Foundation said.