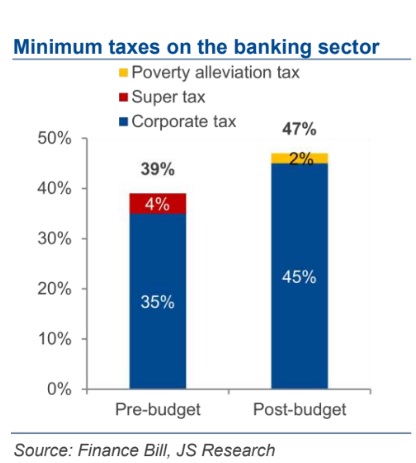

KARACHI: The rate of tax applicable to the taxable income of banking companies is proposed to be enhanced to 45 per cent from 35 per cent for tax year 2023 and onwards. Also, the Finance Bill 2022 proposes to abolish super tax currently applicable on banking companies at the rate of 4 per cent from tax year 2023 and onwards.

It is also proposed that from tax year 2022 onwards, the tax on high earning persons for poverty alleviation at the rate of 2% will also be applicable on the banking companies where the income exceeds Rs300 million.

Amreen Soorani at JS Global Capital said the sector had been laden with hefty taxes across the board, over expanding profits earned by the sector in the ongoing monetary tightening environment, in addition to being penalized for higher income from federal government securities while maintaining a lower ADR (Advances to Deposit Ratio).

“To summarize, the corporate tax rate of 35% (i.e., 39% including 4% super tax has been revised to a rate of 45% (no super tax from now on). We believe that the 2% poverty alleviation tax for all companies reporting profits of over Rs300mn will also be applicable on banks”.

Moreover, additional taxes of 5%/2.5% on income from government securities for banks with Gross ADR below 40% and between 40%-50%, respectively, have been increased to 10%/4%. The raised taxes combined take sector’s effective tax rate from 40% to 51% approximately.

The measures are estimated to collect an increment of Rs70 billion – 80 billion of taxes/annum. This is not a new ordeal for the sector as it has faced corporate tax as high as 58% until 2001, which was then gradually reduced over the years.

While impact on each bank is broadly similar for higher corporate tax, measures that are pinned to investment levels have a relatively higher impact on banks with lower ADR and higher contribution of federal government securities to its total revenue.

Analysts believe, for the higher taxes linked to ADR levels and poverty alleviation, Finance Bill proposes new rates applicable from Tax year 2022, which means CY21 profits for banks.

However, some industry experts view any tax on retrospective basis being eligible to be contested in courts. In the worst case scenario, 2QCY22 results of the sector would report one time hefty tax expenses, taking sequential earnings down by 65 per cent, where a few banks may even report losses.

“If we account for the retrospective working, our projected earnings for CY22 trim by 12% – 32%. The worst case scenario brings the sector’s average Tier I ROE for the next 5 years down from 22% to 18%. Valuations for banks are still at 0.6x P/B and sub 4x P/E beyond CY22”.

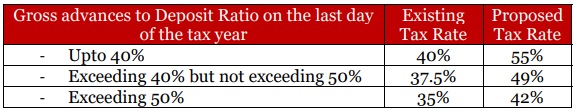

Through the Finance Act, 2021, for the tax year 2022 onwards, higher rate of tax was prescribed for the banking companies in respect of the taxable income attributable to investment in the Federal Government Securities. The said rates are now proposed to be further enhanced in the following manner:

An explanation is also proposed to be added that the said tax rate is applicable to total income attributable to total investment in Federal Government securities.

LIST OF BANKS IN PAKISTAN:

Public Sector Commercial Banks:

Specialized Banks

Punjab Provincial Cooperative Bank Limited

Industrial Development Bank of Pakistan Limited

Local Private Banks

United Bank Limited

Habib Metropolitan Bank Limited

Standard Chartered Bank (Pakistan) Limited

Islamic Banks

Al-Baraka Bank (Pakistan) Limited

Foreign Banks