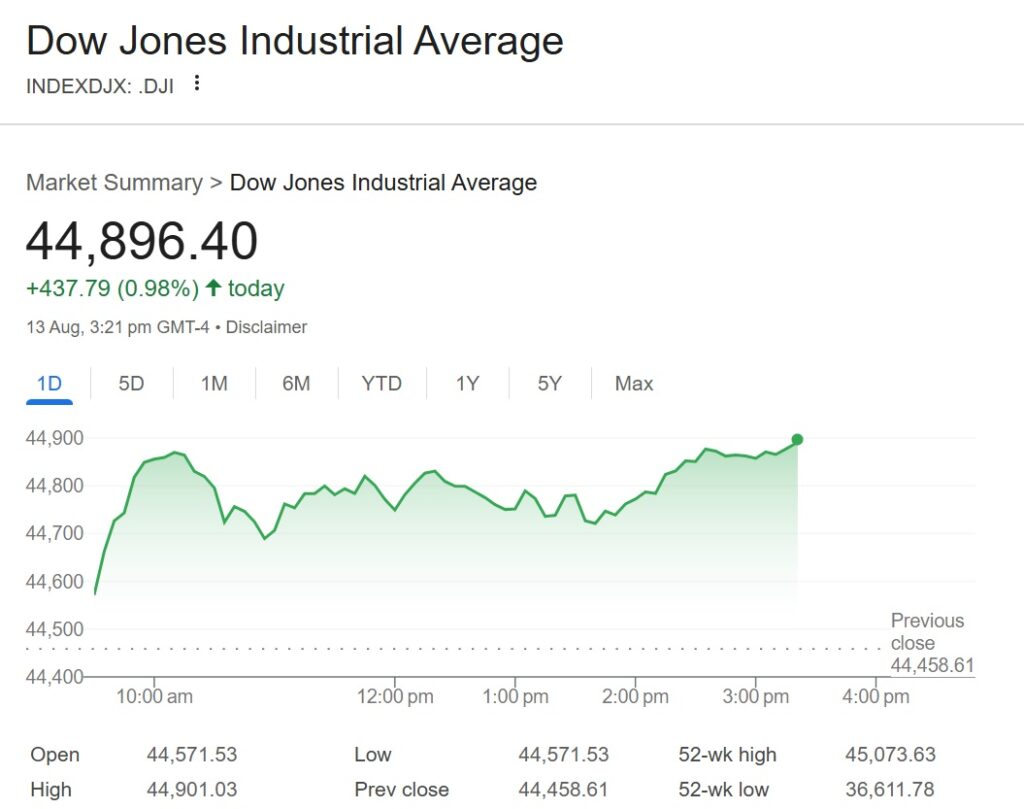

Dow Jones jumps 409 points as rate cut bets fuel market surge

NEW YORK: U.S. stocks rose Wednesday, extending their recent rally as growing expectations for a Federal Reserve rate cut in September propelled major indexes to fresh record highs.

The Dow Jones Industrial Average jumped 409 points, or 0.9%, while the S&P 500 added 0.2% and the Nasdaq Composite edged up 0.1%. Both the S&P and Nasdaq hit new intraday records shortly after the opening bell before paring gains later in the session.

Advanced Micro Devices led tech gains, surging more than 5%, while Apple rose about 1%. Paramount Skydance shares soared over 34%, marking the media company’s best single-day performance since March 2020.

Wednesday’s moves followed a record-setting session Tuesday, fueled by a cooler-than-expected inflation report that bolstered hopes for a Fed rate cut next month. Traders are now pricing in a near 100% probability of a September cut, according to CME’s FedWatch Tool.

“This has been a really impressive earnings season, which showcases kind of a corporate resilience from all the headwinds that we saw across the summer,” said Ross Mayfield, investment strategist at Baird, in an interview with CNBC. “You also had just a really nice kind of breadth.”

Investors rotated out of mega-cap “Magnificent Seven” stocks in favor of smaller companies, with the Russell 2000 climbing 1.4%. Small-cap stocks tend to benefit from lower interest rates, which reduce borrowing costs and may spur consumer spending.

The producer price index report due Thursday will offer further insight into wholesale inflation trends, ahead of the Fed’s closely watched Jackson Hole symposium scheduled for Aug. 21–23.

European markets also closed higher. The pan-European Stoxx 600 rose 0.55%, while London’s FTSE 100 gained 0.19%. France’s CAC 40 added 0.66%, and Germany’s DAX climbed 0.69%.