Dow Jones drops 200 points as traders await key inflation data

NEW YORK: U.S. stocks fell Monday as traders awaited key inflation data later this week, overshadowing a positive development on the trade front.

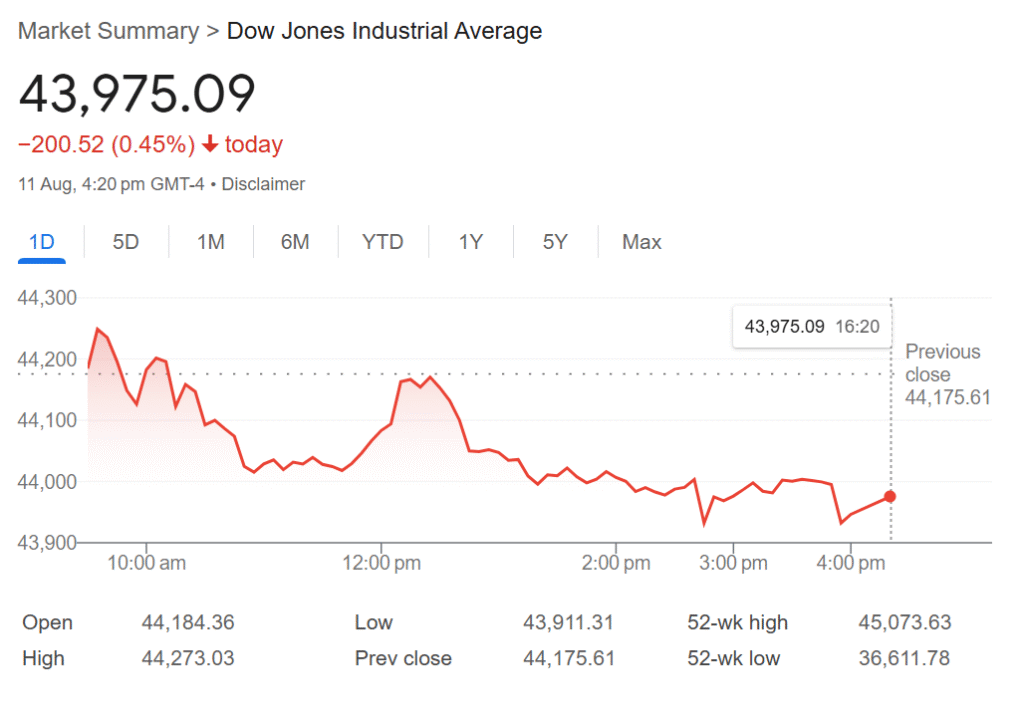

The Dow Jones Industrial Average slipped 200.52 points, or 0.45%, to close at 43,975.09. The S&P 500 lost 0.25%, settling at 6,373.45, while the Nasdaq Composite was down 0.3% to finish at 21,385.40.

Investors are bracing for the consumer price index (CPI) on Tuesday and the producer price index (PPI) on Thursday. These reports will be critical in shaping the Federal Reserve’s outlook on interest rates ahead of its September meeting.

Economists surveyed by Dow Jones are forecasting a 0.2% monthly increase in the July CPI and a 2.8% annual rise. Core CPI, which excludes volatile food and energy prices, is expected to climb 0.3% on a monthly basis and 3.1% yearly, both higher than June’s figures.

The inflation data comes ahead of the Fed’s annual Jackson Hole meeting, which could provide further clues on the central bank’s next move. While the market is currently pricing in an 87% chance of a rate cut in September, some analysts warn that investors may be too optimistic.

“I’m getting a little concerned that the market is going to end up being disappointed,” said Sam Stovall, chief investment strategist at CFRA Research. “The Fed will have a conundrum to deal with if inflation remains sticky and if the consumer remains willing to spend — where is the need to cut rates?”

Meanwhile, a positive development in the U.S.-China trade dispute was largely ignored by the market. President Donald Trump signed an executive order to extend the deadline for tariffs on Chinese goods by 90 days, a move that came just hours before the previous pause was set to expire.