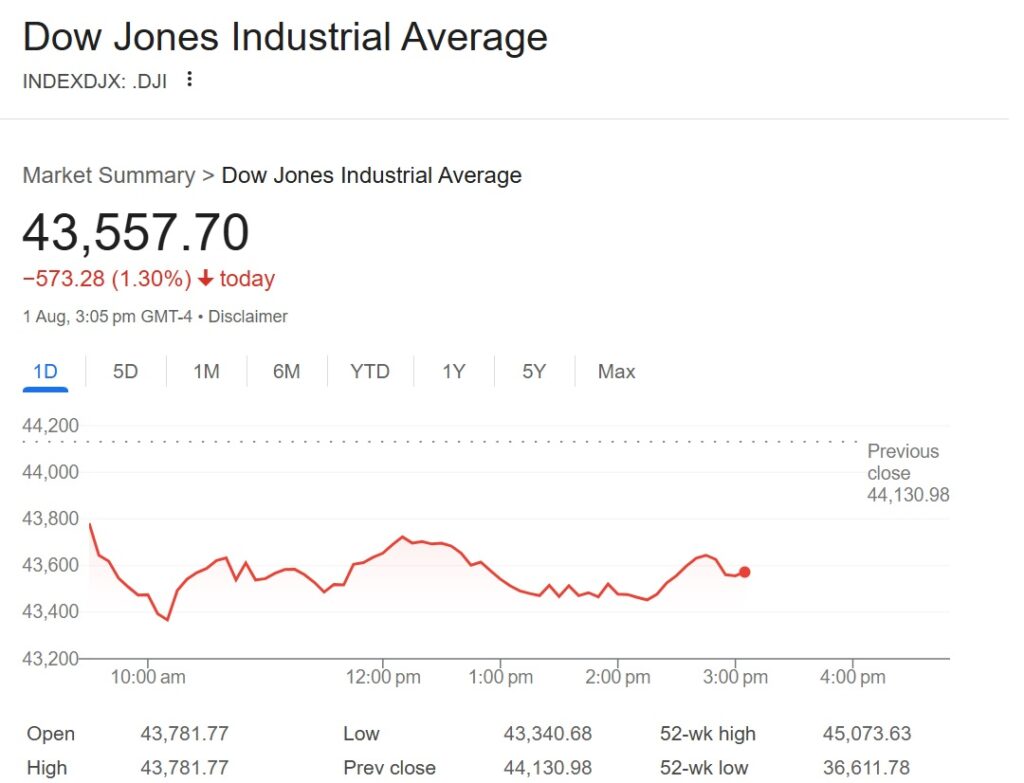

Dow Jones today plunges nearly 500 points as investor confidence shaken

U.S. stocks tumbled Friday as investors digested disappointing labor market data and a fresh wave of tariffs announced by President Donald Trump, sparking fears of a broader economic slowdown.

The Dow Jones Industrial Average fell 498 points, or 1.1%. The S&P 500 dropped 1.5%, and the Nasdaq Composite sank 2.1%, weighed down by tech losses and concerns over global growth.

The July jobs report showed nonfarm payrolls rose by just 73,000, far below the 100,000 expected by economists surveyed by Dow Jones. Revisions to previous months painted an even bleaker picture: June payrolls were cut to 14,000 from 147,000, and May’s total was revised down to 19,000 from 125,000, signaling prolonged weakness in the labor market.

Bank stocks bore the brunt of the selloff. JPMorgan Chase declined more than 2%, while Bank of America and Wells Fargo each fell over 3%. Industrial giants GE Aerospace and Caterpillar also slipped, down 1% and 3%, respectively.

“What we’re seeing is concern about growth at a time when market multiples are elevated,” said Thierry Wizman, global FX and rates strategist at Macquarie Group. “It’s a late summer growth scare, and it validates the dovish stance within the Fed.”

The weak jobs data increased speculation that the Federal Reserve may cut interest rates sooner than expected. Futures trading on the CME placed the odds of a September rate cut at 80%, a sharp reversal from earlier in the week when Fed Chair Jerome Powell signaled caution amid tariff-related inflation risks.

Adding to market jitters, Trump unveiled modified tariff rates overnight, with duties ranging from 10% to 41%. Goods transshipped to avoid tariffs will now face an additional 40% levy, according to the White House. Notably, Canadian imports will be hit with a 35% tariff, up from 25%.

“Traders are locking in gains as tech earnings fade, macro risks grow, and seasonality turns negative,” said Joseph Cusick, portfolio specialist at Calamos Investments. “Valuations are stretched, and defensive positioning is quietly building.”

Amazon shares plunged more than 7% after issuing light operating income guidance for the current quarter. Apple stock dropped about 2%.

The losses followed a lackluster session Thursday, when the S&P 500 posted its third straight decline despite strong earnings from Microsoft and Meta Platforms. Both indices had touched intraday records before the rally fizzled.

Globally, the pan-European Stoxx 600 index closed down 1.8%, its worst session since April, as Trump’s tariff announcement reverberated across international markets. Travel stocks fell 2.7%, and banks dropped 2.9%.

“The fact Trump hasn’t delayed the August 1 deadline to September 1 has soured the tone,” said Russ Mould, investment director at AJ Bell.

Healthcare stocks also came under pressure after Trump sent letters to pharmaceutical executives urging them to cut U.S. drug prices or face regulatory action.

Meanwhile, British Airways parent IAG closed nearly 2% lower despite reporting a 35% year-over-year jump in operating earnings.

Market Summary Table

| Index / Stock | Change | % Move | Notes |

|---|---|---|---|

| Dow Jones Industrial Avg | -498 points | -1.1% | Led by declines in industrial and bank stocks |

| S&P 500 | -1.5% | -1.5% | Third straight losing session |

| Nasdaq Composite | -2.1% | -2.1% | Tech stocks dragged down by Amazon, Apple |

| Amazon | -$XX (approx.) | -7% | Weak operating income guidance |

| Apple | -$XX (approx.) | -2% | Declined amid broader tech weakness |

| JPMorgan Chase | -$XX (approx.) | -2% | Hit by loan growth concerns |

| Bank of America | -$XX (approx.) | -3% | Financials under pressure |

| Wells Fargo | -$XX (approx.) | -3% | Reflects economic slowdown fears |

| GE Aerospace | -$XX (approx.) | -1% | Industrial sector weakness |

| Caterpillar | -$XX (approx.) | -3% | Sensitive to global trade conditions |

| Stoxx 600 (Europe) | -1.8% | -1.8% | Worst session since April |

| Travel Stocks (Europe) | — | -2.7% | Hit by global growth concerns |

| Bank Stocks (Europe) | — | -2.9% | Tariff shock and economic fears |

Note: Dollar changes for individual stocks can be added based on real-time data.