Dow Jones edges down 19 points amid broader market gains, earnings focus

Wall Street stocks advanced Monday, lifting key indexes to record territory, while Treasury yields softened at the start of a busy week for corporate earnings. The gains came despite escalating U.S. tariff negotiations with trading partners ahead of an August 1 deadline.

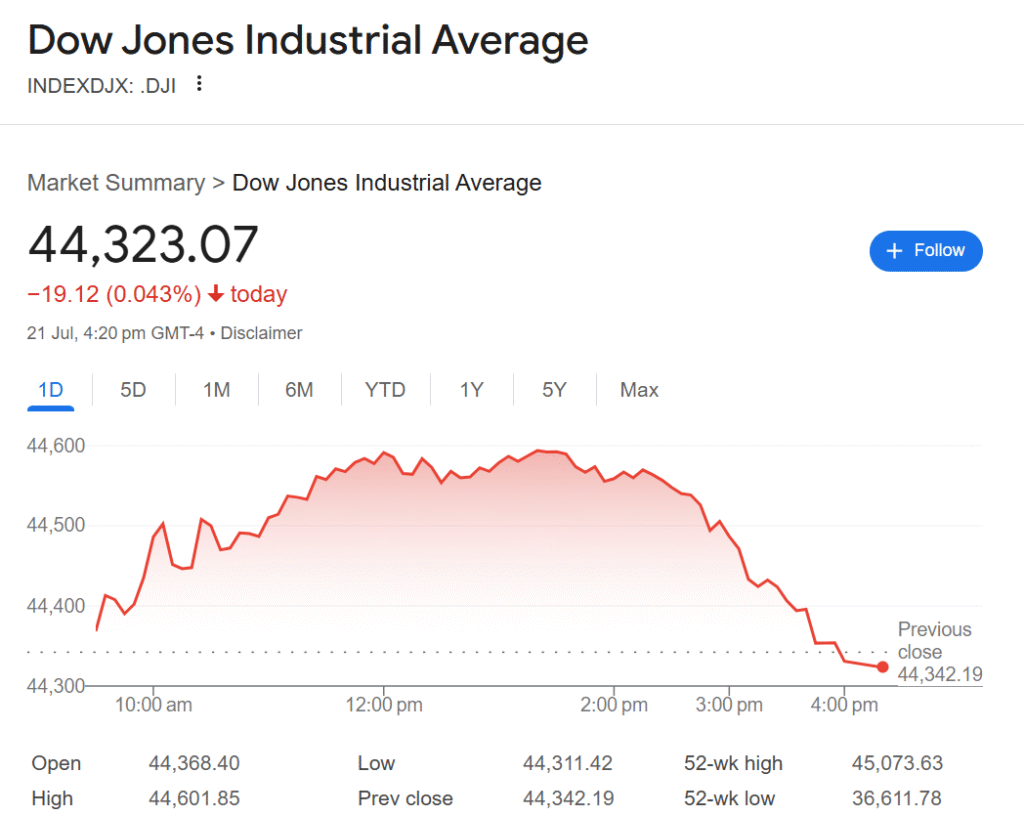

All three major U.S. stock indexes moved higher, contrasting with losses in European markets. The S&P 500 rose 0.14% to close at 6,305.60, its first finish above the 6,300 threshold. The Nasdaq Composite jumped 0.38% to a record closing high of 20,974.17. The Dow Jones Industrial Average slipped slightly, down 19.12 points, or 0.04%, to 44,323.07. Both the S&P 500 and Nasdaq hit new all-time intraday highs earlier in the session.

Communication services and technology-related momentum stocks provided significant upward momentum. Alphabet gained more than 2% ahead of its quarterly results Wednesday. The second-quarter earnings season shifts into high gear this week, featuring reports from Alphabet and Tesla – two of the influential “Magnificent Seven” AI-associated megacap stocks. IBM, Intel, and numerous industrials, including General Motors and Union Pacific, are also scheduled.

“We’ve had optimism around trade, and it’s early days but we’ve had pretty good earnings so far,” said Zachary Hill, head of portfolio management at Horizon Investments in Charlotte, North Carolina. “So it feels a little bit like a summertime, don’t-fight-the-trend environment at the moment.”

Earnings season is off to a strong start. Verizon shares rose 4% after beating second-quarter expectations. Of the 62 S&P 500 companies that have reported thus far, more than 85% have topped expectations, according to FactSet. Second-quarter earnings are tracking 5% year-over-year growth after the first week of results, Bank of America noted.

Trade negotiations continued without yielding significant deals as the deadline approaches for potential new U.S. tariffs. On Sunday, U.S. Commerce Secretary Howard Lutnick called August 1 a “hard deadline,” though he added that talks could continue afterward. “The market’s view of who the tariffs hurt more or less has certainly waxed and waned over the last couple of months,” Hill added. “It’s been a pretty turbulent kind of news flow, I think a lot of U.S. investors have tuned it out.”

Separately, comments from U.S. Treasury Secretary Scott Bessent on CNBC stoked concerns over Federal Reserve autonomy. Bessent said, “I think that what we need to do is examine the entire Federal Reserve institution and whether they have been successful,” following reports President Donald Trump is considering firing Chairman Jerome Powell.

“This is highly politically motivated… both Secretary Bessent, as well as President Trump, have a recognition and understanding of the enormous chaos that a non-independent Fed, or attempts to fire Chairman Powell would have on markets,” said Oliver Pursche, senior vice president at Wealthspire Advisors in New York. “I don’t believe that is their objective or desire.”

In global markets, European stocks ended lower. The pan-European STOXX 600 index fell 0.08%, and the broad FTSEurofirst 300 index fell 0.13%. MSCI’s global stock gauge rose 0.45% to 932.20. Emerging market stocks gained 0.44%. Japan’s Nikkei fell 0.21%.

The dollar weakened, particularly against the yen, which strengthened after Japan’s ruling coalition lost its upper house majority in weekend elections. The dollar index fell 0.53%. Against the yen, the dollar weakened 0.99% to 147.33. The euro gained 0.55% to $1.1689.

U.S. Treasury yields fell as prices rallied. The yield on the benchmark 10-year note fell 6.7 basis points to 4.364%. The 30-year bond yield fell 7.2 basis points to 4.9275%. The 2-year note yield fell 2.5 basis points to 3.85%.

Gold prices hit a five-week high, with spot gold rising 1.33% to $3,393.96 an ounce, benefiting from the softer dollar and lower yields. Oil prices edged lower despite new European sanctions on Russian oil, with U.S. crude settling down 0.2% at $67.20 per barrel and Brent down 0.1% at $69.21 per barrel. Bitcoin fell 0.41% to $117,650.27, reversing gains made after Friday’s signing of the GENIUS Act.

📈 Market Snapshot – July 21, 2025

| Index | Last Close | Change | % Change |

|---|---|---|---|

| Dow Jones Industrial Average | 44,530.47 | +186.58 | +0.42% |

| S&P 500 | 6,330.37 | +33.58 | +0.54% |

| Nasdaq Composite | 21,044.27 | +147.58 | +0.71% |

| MSCI ACWI (Global Stocks) | 932.20 | +4.21 | +0.45% |

🌍 International Markets

| Index | Value | Change | % Change |

|---|---|---|---|

| STOXX 600 (Europe) | — | — | -0.08% |

| FTSEurofirst 300 | — | -2.82 pts | -0.13% |

| MSCI Emerging Markets | 1,254.91 | +5.55 pts | +0.44% |

| MSCI Asia-Pacific (ex-Japan) | 659.31 | +0.21% | +0.21% |

| Nikkei 225 (Japan) | 39,819.11 | -82.08 pts | -0.21% |

💵 Currencies

| Pair | Value | Change | % Change |

|---|---|---|---|

| U.S. Dollar Index | 97.88 | -0.53% | — |

| EUR/USD | $1.1689 | +0.55% | — |

| USD/JPY | 147.33 | -0.99% | — |

📊 Treasury Yields

| Instrument | Yield | Change (bps) |

|---|---|---|

| 10-year Note | 4.364% | -6.7 |

| 30-year Bond | 4.9275% | -7.2 |

| 2-year Note | 3.85% | -2.5 |

💰 Commodities & Crypto

| Asset | Value | % Change |

|---|---|---|

| U.S. Crude | $67.20/bbl | -0.2% |

| Brent Crude | $69.21/bbl | -0.1% |

| Gold (Spot) | $3,393.96/oz | +1.33% |

| Gold (Futures) | $3,403.10/oz | +1.49% |

| Bitcoin | $117,650.27 | -0.41% |

| Ethereum | $3,763.27 | +0.57% |