U.S. stocks rebounded Wednesday after President Donald Trump said he has no intention of firing Federal Reserve Chair Jerome Powell, easing investor concerns about potential leadership upheaval at the central bank.

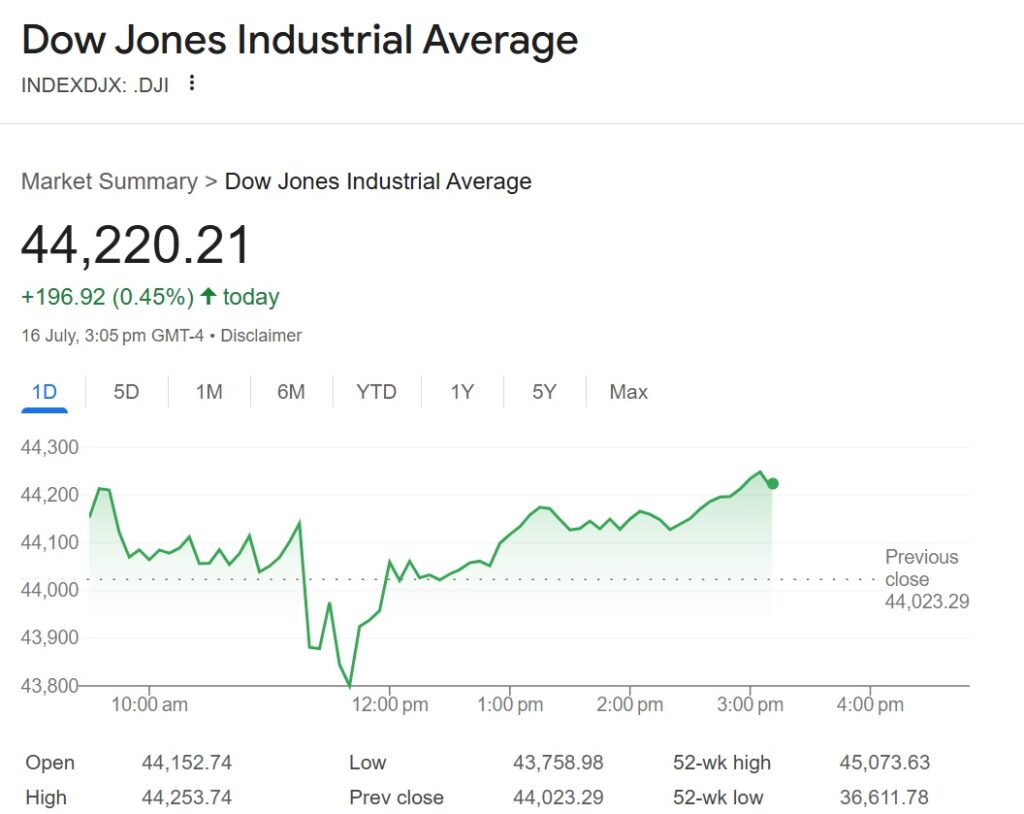

The major indexes fell as much as 0.8% late morning following a report in The Wall Street Journal that Trump suggested to GOP lawmakers he might soon remove Powell. But markets turned around after Trump denied the claim around noon, telling reporters he has no plans to dismiss the Fed chief.

Stocks rallied through the afternoon, with the Dow Jones Industrial Average climbing up to 0.5% in late trading. The S&P 500 and Nasdaq also posted modest gains.

Financial stocks remained under pressure despite the broader recovery. Morgan Stanley shed 2% and several major lenders ended the day lower, as investors feared a leadership shift could trigger inflation volatility and unsettle bond markets.

Long-term Treasury bonds sold off after the initial reports. The 30-year yield rose about 0.1 percentage point, with yields climbing as inflation expectations mount.

The back-and-forth added to the uncertainty surrounding Powell’s future, a topic that has weighed on Wall Street. Trump had previously said he wouldn’t fire the Fed chief, a statement echoed by Treasury Secretary Scott Bessent on Tuesday.

Earlier in the day, earnings results helped lift investor sentiment. Bank of America, Goldman Sachs and Morgan Stanley all reported stronger-than-expected profits, buoyed by volatile trading tied to global tariff tensions.

In late-day trading, indexes hovered near all-time highs. The dollar fell amid ongoing speculation about Fed leadership, and Treasury yields swung sharply. European markets were muted, with ASML and Renault shares sliding.