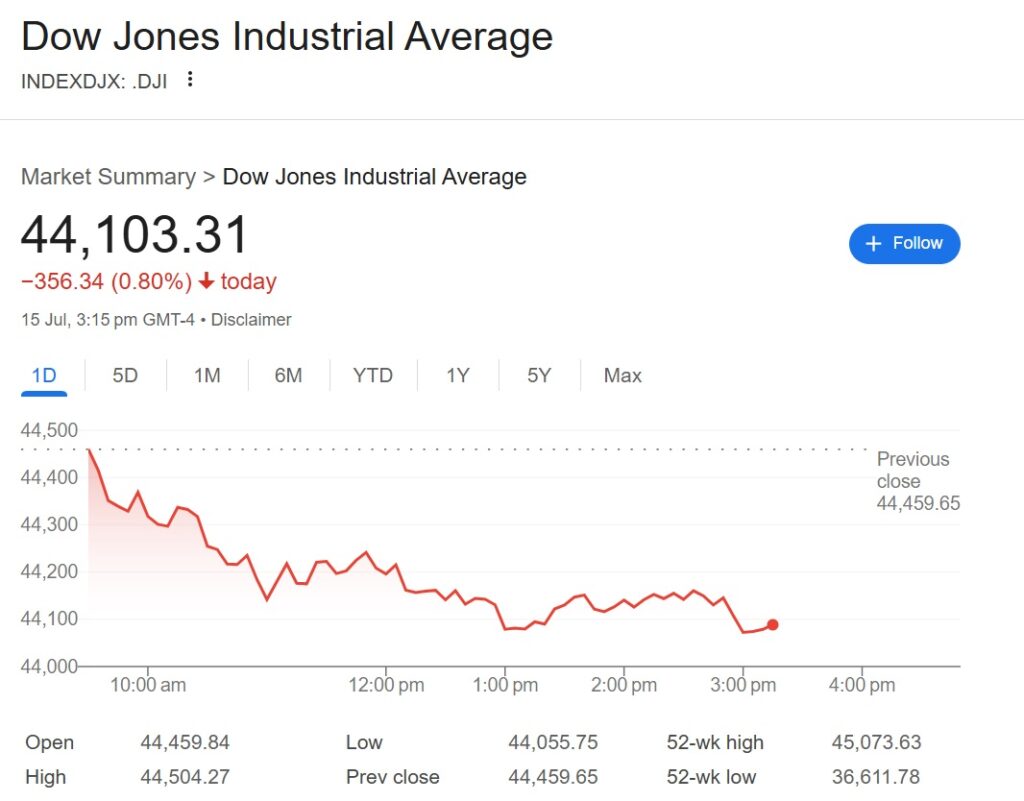

Dow Jones slumps over 300 points as financials weigh; Nasdaq hits record

U.S. Treasury yields climbed and the Dow Jones Industrial Average fell on Tuesday after Treasury Secretary Scott Bessent initiated the formal selection process for a new Federal Reserve chair, while June inflation data met expectations but fueled tariff concerns.

The Dow slid 313 points (0.7%) as financial stocks slumped despite strong bank earnings, while the Nasdaq Composite rose 0.6% to a record high, lifted by semiconductor giant Nvidia. The S&P 500 ended flat after touching an intraday record.

Key Market Movements

| Index/Asset | Change | Details |

|---|---|---|

| Dow Jones Industrial | -0.7% | Led by financial sector losses |

| Nasdaq Composite | +0.6% | Boosted by Nvidia (+4%) |

| S&P 500 | Flat | Eased from earlier record high |

| 10-Year Treasury Yield | +8 bps | Rose to 4.49% |

| Citigroup Stock | +1% | Topped earnings estimates |

Inflation and Trade Pressures

June’s Consumer Price Index (CPI) showed annual inflation rose to 2.7% from May’s 2.4%, matching forecasts but intensifying worries about the impact of U.S. tariffs. Core CPI (excluding food/energy) grew 2.9% year-over-year.

Table: June Inflation Snapshot

| Metric | Value (YoY) | Monthly Change | Vs. Expectations |

|---|---|---|---|

| Headline CPI | 2.7% | +0.3% | Matched |

| Core CPI | 2.9% | +0.2% | Slight miss (0.3% est.) |

“Trump’s tariffs pushed up consumer prices in June,” said Matthew Ryan of Ebuy, noting August’s planned 30% EU/Mexico tariffs could worsen inflation.

Sector Highlights

Financials:

- JPMorgan and Wells Fargo beat Q2 profit estimates, but shares fell 1% and 4% respectively on weak guidance.

- BlackRock tumbled 6% despite becoming the first $12 trillion asset manager; revenue missed estimates amid fund outflows.

- Citigroup gained 1% after topping earnings forecasts.

Technology:

- Nvidia surged 4% after securing U.S. approval to resume H20 chip sales in China.

Trade Developments:

- The U.S. struck a tariff deal with Indonesia: 19% on Indonesian goods vs. 0% for U.S. exports.

- President Trump’s July 7 threat of 32% tariffs on Indonesia was averted.

Global Markets

European shares fell for a third session (Stoxx 600: -0.4%), pressured by U.S. inflation data and trade tensions. Sweden’s Ericsson slid 7.7% as tariffs hit margins, while U.K. builder Barratt Redrow plunged 9.4% on missed targets.

Earnings and Outlook

Q2 earnings season faces low expectations, with S&P 500 profits forecast to grow just 4.3% year-over-year—the slowest pace since 2023.

“The Fed chair search adds uncertainty amid sticky inflation,” said Skyler Weinand of Regan Capital. “A tariff-driven reckoning is likely ahead.”