Dow Jones slips 0.4% as trade uncertainty lingers

U.S. stocks closed narrowly mixed Tuesday as investors digested President Donald Trump’s decision to delay the return of sweeping tariffs while bracing for renewed trade tensions in August.

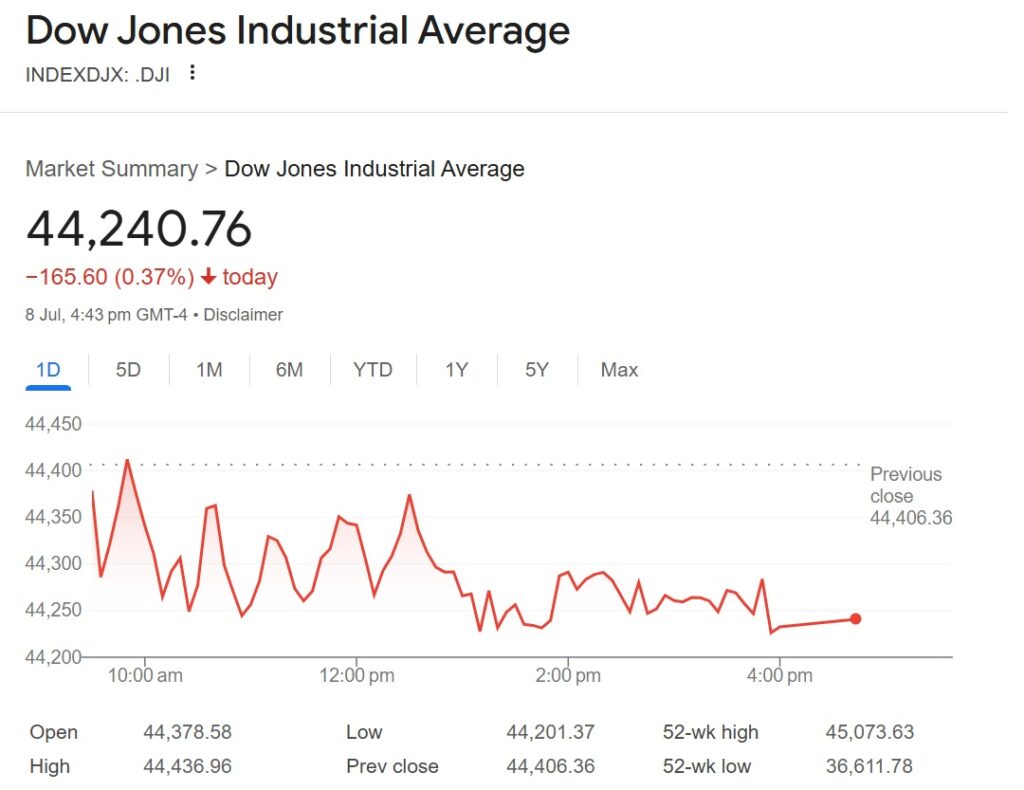

The S&P 500 (GSPC) edged down less than 0.1%, while the Dow Jones Industrial Average (DJI) fell 0.4%. The Nasdaq Composite (IXIC) inched up less than 0.1%, recovering slightly from Monday’s broad sell-off.

Trump extended the deadline for reinstating “Liberation Day” tariffs from July 9 to Aug. 1, giving the U.S. and trading partners more time to negotiate. However, he warned there would be no further extensions and threatened new tariffs on copper (50%) and pharmaceuticals (up to 200%).

Key Market Moves

| Index/Asset | Change | Notes |

| S&P 500 | -0.1% | Pulled back from record high |

| Dow Jones | -0.4% | Third straight decline |

| Nasdaq | +0.05% | Tech shares mixed |

| 10-Year Yield | 4.41% | Up slightly from Monday |

| Bitcoin | $108,700 | Recovering from overnight dip |

| WTI Crude | $68.10/barrel | +0.3% |

Sector Highlights

- Tech: Tesla (TSLA) rose 1.3%, rebounding after CEO Elon Musk’s political party announcement. Nvidia (NVDA) gained 1%, nearing a $4 trillion market cap.

- Solar Stocks: First Solar (FSLR) plunged 6.5% after Trump signed an order cutting federal support for alternative energy.

- Oil & Pharma: Devon Energy (DVN) surged 7%, while Pfizer (PFE) and Amgen (AMGN) pared gains on tariff fears.

- Retail: Amazon (AMZN) fell 1% as Prime Day began, with investors watching for tariff-related price hikes.

What’s Next

- Fed Minutes (Wednesday) could offer clues on interest rate policy.

- Delta Air Lines (DAL) kicks off earnings season Thursday.

- Aug. 1 tariff deadline looms as negotiations continue.