U.K. equities slump as Reeves’ position triggers investor unease; European banking stocks shine

LONDON: European stock markets closed slightly higher Wednesday, led by gains in continental banks and mining shares, while U.K. equities wobbled amid political uncertainty surrounding Chancellor Rachel Reeves.

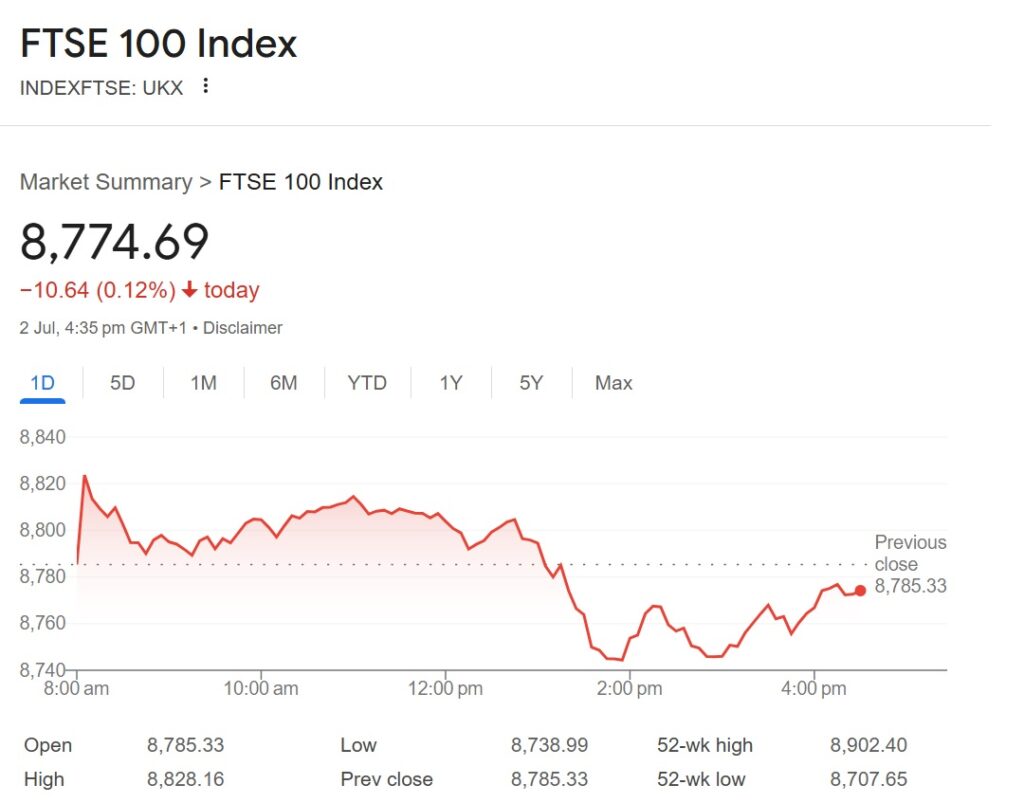

The pan-European Stoxx 600 index rose 0.2%, recovering from an earlier dip into negative territory. France’s CAC 40 climbed 1.0%, and Germany’s DAX gained 0.5%. However, the U.K.’s FTSE 100 dipped 0.1%, weighed down by housebuilders and mid-cap stocks.

Downing Street reaffirmed that Reeves would remain in office, despite Prime Minister Keir Starmer declining to explicitly support her during parliamentary questioning. Market volatility deepened after the government reversed course on welfare reforms, leaving a £5 billion gap in the fiscal framework.

Major Index Closures

| Index | Value | Change | % Change |

|---|---|---|---|

| FTSE 100 | 8,774.69 | -10.64 | -0.1% |

| FTSE 250 | 21,452.49 | -290.67 | -1.3% |

| AIM All-Share | 767.76 | -5.18 | -0.7% |

| Cboe UK 100 | 875.21 | -0.2% | -0.2% |

| Cboe UK 250 | 18,940.35 | -1.4% | -1.4% |

| Cboe Small Cos. | 17,410.86 | -0.1% | -0.1% |

| CAC 40 | — | — | +1.0% |

| DAX 40 | — | — | +0.5% |

Currency & Bond Market Snapshot

| Instrument | Wednesday | Tuesday |

|---|---|---|

| GBP/USD | $1.3612 | $1.3705 |

| EUR/USD | $1.1781 | $1.1770 |

| USD/JPY | JP¥143.85 | JP¥143.62 |

| UK 10-Year Bond Yield | 4.68% | 4.45% |

| US 10-Year Treasury | 4.29% | 4.26% |

| US 30-Year Treasury | 4.83% | 4.79% |

Kathleen Brooks of XTB noted the pound’s decline alongside rising bond yields as “a sign of fiscal stress.” Reeves, reportedly tearful in Commons, faced heightened scrutiny as investors questioned how Labour would plug the welfare shortfall.

FTSE 100 Top Movers

| Biggest Risers | Price (p) | Change |

|---|---|---|

| Glencore | 306.00 | +14.75 |

| Antofagasta | 1,916.00 | +84.00 |

| Spirax | 6,175.00 | +260.00 |

| Anglo American | 2,263.50 | +90.50 |

| Ashtead Group | 4,788.00 | +141.00 |

| Biggest Fallers | Price (p) | Change |

|---|---|---|

| Berkeley Group | 3,600.00 | -308.00 |

| Persimmon | 1,210.50 | -88.00 |

| NatWest | 473.80 | -27.60 |

| ConvaTec | 257.40 | -14.60 |

| Land Securities | 600.00 | -33.50 |

Company Highlights

- Bytes Technology plunged 33%, citing macroeconomic headwinds and deferred client purchases.

- Greggs fell 15% after warning of lower profits due to hot weather reducing baked goods demand.

- Topps Tiles surged 8.8% following a double-digit rise in quarterly sales and margin expectations.

Commodities

| Commodity | Price (Wed) | Price (Tue) |

|---|---|---|

| Brent Oil | $67.57 | $66.97 |

| Gold | $3,341.71 | $3,286.04 |

Thursday’s U.S. jobs report looms, with payroll processor ADP recording a surprising 33,000 job decline in June. Analysts say investor focus may soon shift to fiscal and labor signals from Washington.