Tech slump offsets Dow gains as Trump-Musk feud, tariff worries rattle investors

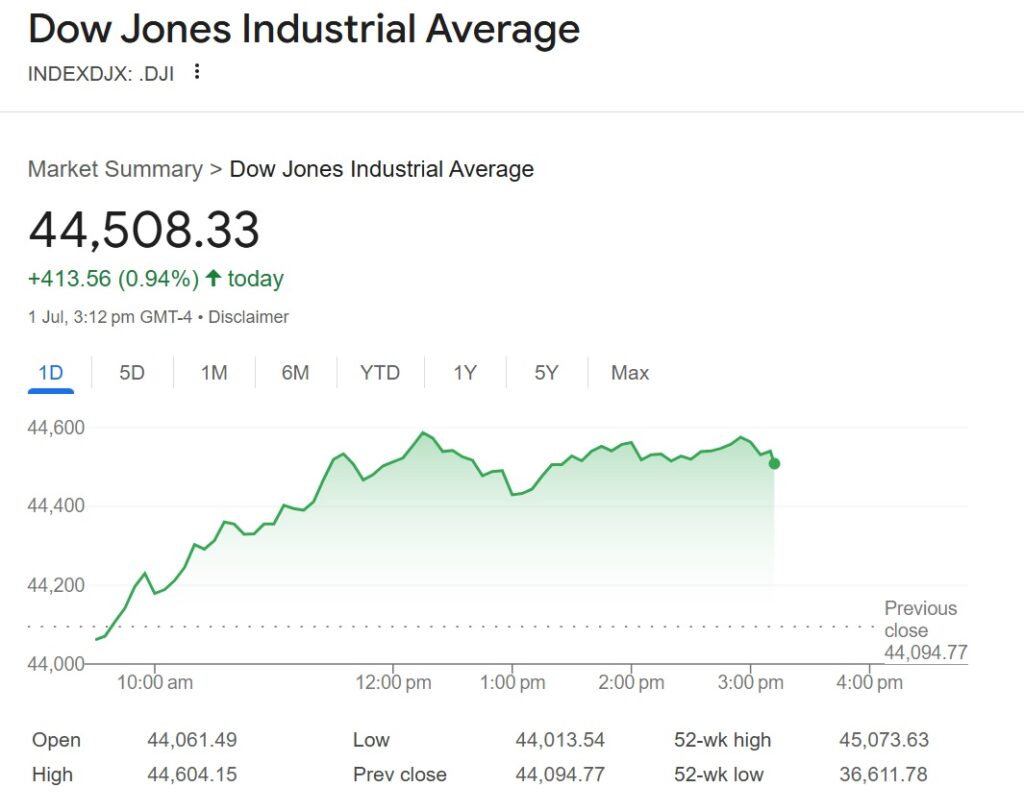

U.S. stocks were mixed in afternoon trading Tuesday, with the Dow Jones Industrial Average climbing to a five-month high while tech stocks dragged on the broader market.

The S&P 500 edged up 0.1%, while the Dow gained 452 points, or 1%, to 44,500—its highest level since early February. The Nasdaq Composite fell 0.5%, weighed down by declines in Tesla and Nvidia.

Key Market Movers

| Index | Change (%) | Points | Time (ET) |

|---|---|---|---|

| Dow Jones | +1.0% | +452 | 2:02 p.m. |

| S&P 500 | +0.1% | +5 | 2:02 p.m. |

| Nasdaq | -0.5% | -85 | 2:02 p.m. |

Tesla (TSLA) tumbled 5.6% amid escalating tensions between CEO Elon Musk and President Donald Trump. Trump suggested reviewing federal subsidies to Musk’s companies, adding to investor concerns. The stock is down more than 21% year-to-date.

Nvidia (NVDA), a leader in the AI boom, dropped 2.1%, marking the heaviest drag on the S&P 500. The chipmaker has seen massive gains in recent years, but insider stock sales and trade uncertainties have sparked profit-taking.

Sector Highlights

- Casino stocks surged after Macao reported stronger-than-expected gaming revenue. Wynn Resorts (WYNN) jumped 8.8%, and Las Vegas Sands (LVS) rose 8.9%.

- Automakers rallied, with General Motors (GM) up 4.7% and Ford (F) gaining 3.9%.

- Health stocks led the Dow’s gains, offsetting tech weakness.

Economic Concerns Loom

Investors remain cautious as Trump’s proposed tariffs—currently paused—could take effect within days, potentially worsening inflation. Meanwhile, Congress debates tax cuts that may increase U.S. debt, further pressuring markets.

Federal Reserve Chair Jerome Powell reiterated Tuesday that the central bank needs more data before considering further rate cuts, despite political pressure. The 10-year Treasury yield inched up to 4.25%, while the 2-year yield rose to 3.78%.

Global Markets Mixed

- Japan’s Nikkei 225 fell 1.2%.

- South Korea’s Kospi rose 0.6%.

- European indexes were narrowly mixed.

Manufacturing Shows Signs of Recovery

The S&P Global U.S. Manufacturing PMI rose to 49.0 in June from 48.5, though still in contraction territory. Analysts warn that trade uncertainties could hinder growth.

Despite recent record highs, Barclays strategists noted signs of excessive optimism in markets, drawing comparisons to the meme-stock frenzy and dot-com bubble eras.