The world of finance is a dynamic and complex ecosystem. Stock markets play a pivotal role in this landscape, serving as platforms where companies raise capital, investors trade securities, and economic forces intersect. These markets are influenced by a myriad of factors, including economic indicators, corporate performance, and global events.

By understanding stock markets, individuals can make informed investment decisions and better capitalize on emerging financial opportunities.

Why Movies Matter

Movies have a unique ability to convey powerful messages. When it comes to movies on stock exchanges, they serve a dual purpose: education and entertainment. Here’s why they matter:

Education: Stock market movies often simplify intricate financial concepts, making them accessible to a broader audience. Whether it’s explaining stock trading, market volatility, or investment strategies, these films break down complex ideas into relatable narratives. As viewers, we gain insights into the mechanics of stock markets, risk management, and financial decision-making.

Inspiration and Cautionary Tales: Stock market movies showcase success stories, failures, and ethical dilemmas faced by investors and traders. They inspire us to learn from both triumphs and pitfalls. From the rags-to-riches journey of a stock trader to the consequences of greed and speculation, these films provide valuable lessons.

Entertainment: Beyond education, stock market movies entertain us. They blend drama, suspense, and intrigue with financial themes. Whether it’s the adrenaline rush of a high-stakes trade or the tension during a market crash, these films keep us engaged while shedding light on the industry.

Movies on stock exchange offer a window into the financial world, combining knowledge with cinematic storytelling. As we explore the top ten films in this genre, we’ll discover their impact on our understanding of markets and investing.

Inside Job (2010)

Let’s delve into the documentary “Inside Job” and explore its significance in understanding the 2008 global financial crisis.

Overview

“Inside Job” is a compelling American documentary film directed by Charles Ferguson. Released in 2010, it meticulously dissects the late-2000s financial crisis, which had far-reaching consequences. With a cost exceeding $20 trillion, this crisis led to widespread job losses, home foreclosures, and a recession comparable to the Great Depression. The film provides a comprehensive analysis of the events that triggered this economic catastrophe.

Themes

The documentary revolves around several key themes:

- Greed: “Inside Job” exposes the rampant greed within the financial services industry. It reveals how financial institutions prioritized profits over ethical considerations, ultimately jeopardizing the global economy.

- Financial Crisis: The film meticulously traces the sequence of events that culminated in the crisis. From the collapse of Lehman Brothers to the unraveling of AIG, it highlights the interconnectedness of financial institutions and their impact on the world economy.

- Role of Wall Street Insiders: Through extensive research and interviews, the film sheds light on the role played by Wall Street insiders—bankers, economists, and politicians. Their decisions and actions significantly contributed to the crisis.

Key Figures

“Inside Job” features interviews with economists, politicians, journalists, and financial experts. These individuals provide valuable insights into the systemic corruption that plagued the United States during this period.

Impact

The film serves as a cautionary tale, emphasizing how unchecked greed can devastate economies. By examining conflicts of interest, deregulation, and academic research, it prompts viewers to reflect on the consequences of financial misconduct.

“Inside Job” received critical acclaim for its thorough research, clear exposition, and pacing. It was screened at the 2010 Cannes Film Festival and won the Academy Award for Best Documentary Feature in 2011.

Chasing Madoff (2010)

True Story

“Chasing Madoff” chronicles the relentless pursuit of truth by a small group of investigators led by Harry Markopolos. Their mission: to expose the harrowing reality behind the infamous Madoff scandal. For a decade, Markopolos pieced together evidence, meticulously documenting Bernie Madoff’s fraudulent activities.

Jordan Belfort Connection

The film shares thematic similarities with “The Wolf of Wall Street.” Both delve into the dark underbelly of financial schemes, revealing the allure of ill-gotten gains and the devastating consequences for those caught in the web of deceit.

Unmasking Fraud

Markopolos and his team were on a quest for justice. They meticulously unraveled Madoff’s elaborate Ponzi scheme, which scammed an estimated $18 billion (or $65 billion, including fake returns) from unsuspecting investors. The film sheds light on the inner workings of white-collar predators—bankers, lieutenants, and henchmen—who enabled Madoff’s deception.

“Chasing Madoff” serves as a stark reminder that even in the world of high finance, truth can be elusive, and greed can blind even the most sophisticated investors.

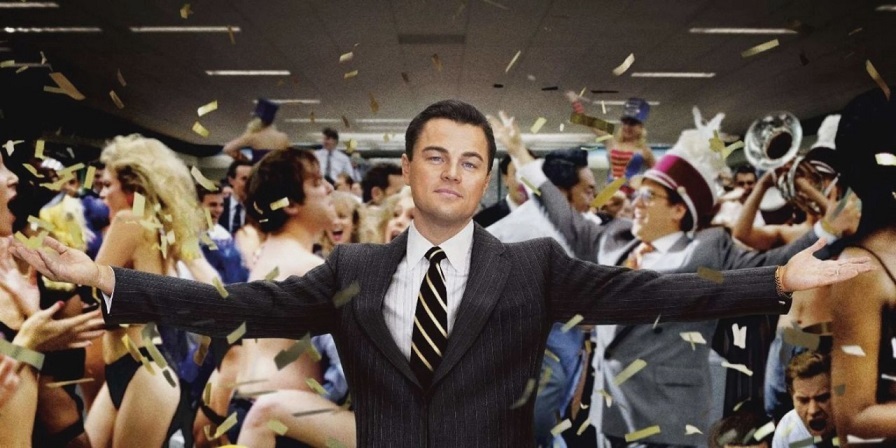

The Wolf of Wall Street (2013)

Infamous Stockbroker

“The Wolf of Wall Street” is a 2013 American black comedy film directed by Martin Scorsese and produced by Leonardo DiCaprio. The story revolves around Jordan Belfort, a stockbroker working on Wall Street in New York City during the 1990s. Belfort runs a company that engages in stock fraud and insider trading. The film is based on Belfort’s memoirs.

Scandal and Excess

The movie delves into the dark side of stockbroking, portraying the excesses, hedonism, and unscrupulous practices prevalent in the financial industry. Jordan Belfort’s rise to power and subsequent downfall serve as a cautionary tale about the allure of wealth and the consequences of unchecked ambition.

Charlie Sheen Cameo

A memorable moment in the film occurs when actor Charlie Sheen makes a cameo appearance. His presence adds an intriguing layer to the narrative, connecting the fictional world of Belfort with real-life Wall Street culture.

“The Wolf of Wall Street” is a rollercoaster ride through the highs and lows of financial excess, leaving viewers both entertained and contemplative.

The Big Short (2015)

Michael Lewis’ Book

“The Big Short” is based on Michael Lewis’ non-fiction book of the same name. Lewis meticulously unravels the events leading up to the 2008 housing market collapse. The film introduces us to a group of savvy investors who saw the impending disaster and bet against the housing market.

Ryan Gosling’s Role

The star-studded cast includes Ryan Gosling, who portrays Jared Vennett, a slick Wall Street trader. Gosling’s performance adds charisma and depth to the film, making it both informative and entertaining.

Complex Financial Concepts

What sets “The Big Short” apart is its ability to explain intricate financial concepts in an engaging way. From collateralized debt obligations (CDOs) to credit default swaps (CDS), the film breaks down these terms for viewers without assuming prior knowledge.

In summary, “The Big Short” is a gripping exploration of financial foresight, greed, and the consequences of a broken system. It’s a must-watch for anyone curious about the inner workings of the 2008 crisis.

Wall Street: Money Never Sleeps (2010)

Gordon Gekko Returns

“Wall Street: Money Never Sleeps” takes place 23 years after the original film. The plot revolves around the 2008 financial crisis. Gordon Gekko, portrayed by Michael Douglas, is supposedly reformed and seeks to repair his relationship with his estranged daughter, Winnie (played by Carey Mulligan). With the help of her fiancé, Jacob Moore (Shia LaBeouf), Gekko navigates the post-crisis Wall Street landscape.

Financial World in Flux

Set against the backdrop of the global economic collapse, the film explores the turmoil and uncertainty faced by financial institutions. It captures the aftermath of the crisis, where old alliances crumble, and new opportunities emerge.

Investment Banks and Ethics

“Wall Street: Money Never Sleeps” delves into ethical dilemmas within investment banks. It raises questions about greed, accountability, and the impact of financial decisions on individuals and society.

In summary, the film continues the saga of power, ambition, and intrigue in the high-stakes world of finance, offering a thought-provoking glimpse into the aftermath of the 2008 meltdown.

Enron: The Smartest Guys in the Room (2005)

Corporate Scandal

“Enron: The Smartest Guys in the Room” chronicles the meteoric rise and subsequent fall of Enron, once the seventh-largest corporation in the United States. Behind its facade of success lay a web of deception, corruption, and financial malfeasance.

Financial Manipulation

The film delves into the intricate strategies and “special purpose” entities that Enron manufactured to hide enormous losses and debt from shareholders and the public. These deceptive practices ultimately led to the company’s downfall.

Lessons for Investors

The Enron saga serves as a stark reminder of the importance of due diligence. Investors must remain vigilant, scrutinizing corporate practices and financial statements to avoid falling victim to similar schemes.

“Enron: The Smartest Guys in the Room” is a compelling cautionary tale that exposes the dark underbelly of corporate greed and the devastating consequences it can unleash.

Barbarians at the Gate (1993):

“Barbarians at the Gate” is a gripping corporate takeover drama that delves into the high-stakes world of Wall Street. Here’s a brief overview of its key elements:

Corporate Takeover Drama: The film is based on the true story of the RJR Nabisco takeover in the late 1980s. It explores the intense battle between rival companies vying for control of RJR Nabisco, a massive tobacco and food conglomerate. Expect intrigue, backroom negotiations, and strategic maneuvering as executives and investors vie for supremacy.

Wall Street Culture: The movie portrays the cutthroat environment of Wall Street, where greed, ambition, and power struggles are the norm. Characters engage in ruthless tactics to gain an upper hand in the corporate world. The film sheds light on the financial wheeling and dealing that shapes major business decisions.

Legacy: Barbarians at the Gate has become a classic in stock market cinema. Its portrayal of corporate battles and the human drama behind them continues to resonate with audiences. Whether you’re interested in finance, business, or just a good story, this film is worth watching.

Margin Call (2011):

Margin Call is a 2011 American drama film written and directed by J. C. Chandor. The story unfolds over a 24-hour period at a large Wall Street investment bank during the initial stages of the 2007–2008 financial crisis. Here’s a brief overview of the film:

Crisis Unfolds: The film captures the actions taken by a group of employees as the financial collapse looms. An unnamed investment bank begins laying off a significant number of employees, including Eric Dale, the head of risk management.

Directorial Debut: J. C. Chandor’s debut film provides a gripping portrayal of the financial world, emphasizing the high stakes faced by those working in the industry.

Ethical Dilemmas: As the crisis escalates, characters grapple with personal and moral implications, making tough choices that impact their lives and the fate of the bank.

The ensemble cast includes Kevin Spacey, Paul Bettany, Jeremy Irons, Zachary Quinto, Penn Badgley, Simon Baker, Mary McDonnell, Demi Moore, and Stanley Tucci. The film received positive critical reviews and earned award nominations for its screenplay and direction.

Here are some finance-related documentaries available on Netflix that you might find interesting:

Money Explained: This Vox-produced show covers topics such as credit scores, the stock market, student loans, retirement planning, and more. It’s a comprehensive overview of how money works in our world today.

Get Smart With Money: Financial advisors provide straightforward strategies for spending less and saving more. It’s a relatable introduction to money management.

Eat the Rich: The GameStop Saga: This documentary explores the impact of the GameStop share price surge in January 2021, which changed Wall Street forever. It delves into why this event happened and how online traders influenced it.

Dirty Money: This series exposes corporate greed and unethical practices, from crooked payday lenders to cheating car companies. It also looks at how governments fight against corporate fraud.

The Minimalists: Joshua Fields Millburn and Ryan Nicodemus promote minimalism, which can have financial implications. Their movement encourages intentional living and mindful spending.