Dow Jones edges lower as tech rout deepens, Fed minutes stir rate cut debate

Wall Street closed lower on Wednesday as investors pulled back from high-flying technology stocks for a second consecutive session, while digesting mixed retail earnings and the Federal Reserve’s latest meeting minutes.

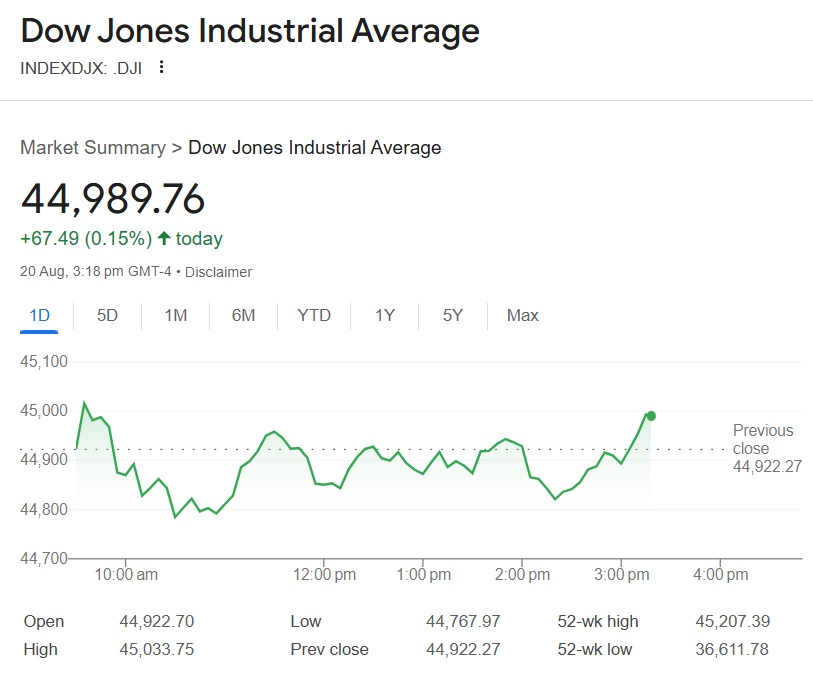

The Nasdaq Composite fell 1%, weighed down by steep losses in semiconductor and AI-linked names. The S&P 500 declined 0.4%, and the Dow Jones Industrial Average shed 16 points, or 0.1%.

Heavyweight chipmakers led the retreat, with Nvidia down 3%, AMD and Broadcom off more than 3.5%, and Intel tumbling over 6%. Palantir dropped 5.5%, while mega-cap tech firms Apple, Amazon, Alphabet and Meta also posted losses.

“It’s not a surprise to see some investors taking profits in tech stocks, which have had an incredibly strong run — with some up over 80% since the early April lows,” said Carol Schleif, chief market strategist at BMO Private Wealth. “Late August typically sees thin volumes, amplifying volatility beyond what fundamentals suggest.”

Retail earnings painted a mixed picture. Target shares sank 6% after reporting another sales decline and naming a new CEO effective February 1. Lowe’s edged higher after beating earnings expectations.

The Fed’s July meeting minutes revealed policymakers remain cautious on inflation and labor market dynamics. While rates were held steady, dissent from Governors Christopher Waller and Michelle Bowman marked the first dual dissent since 1993.

“Participants generally pointed to risks to both sides of the Committee’s dual mandate,” the minutes noted, with most viewing inflation as the greater threat, though some flagged employment risks as more pressing.

Investors now await remarks from Fed Chair Jerome Powell on Friday for clues on rate trajectory. According to CME’s FedWatch tool, futures imply an 85% chance of a rate cut in September.

“If Powell’s language is more hawkish, that could pressure tech stocks even further,” Schleif added. “Elevated interest rates remain a headwind for the sector.”

📊 Major Index and Stock Moves

| Index/Stock | Move (%) | Commentary |

| Nasdaq Composite | -1.00% | Led by tech and semiconductor declines |

| S&P 500 | -0.40% | Broad-based weakness |

| Dow Jones Industrial Avg | -0.10% | Minor dip amid mixed earnings |

| Nvidia | -3.00% | Profit-taking after strong AI-driven rally |

| AMD, Broadcom | -3.50%+ | Semiconductor sector under pressure |

| Intel | -6.00%+ | Sharp drop amid valuation concerns |

| Palantir | -5.50% | AI-linked names retreat |

| Target | -6.00% | Sales decline, CEO transition |

| Lowe’s | +0.50% | Earnings beat supports modest gain |