Dow Jones jumps 463 points as inflation data sparks rate cut optimism

NEW YORK: U.S. stocks surged Tuesday after fresh inflation data came in slightly below expectations, bolstering hopes that the Federal Reserve may cut interest rates as soon as next month.

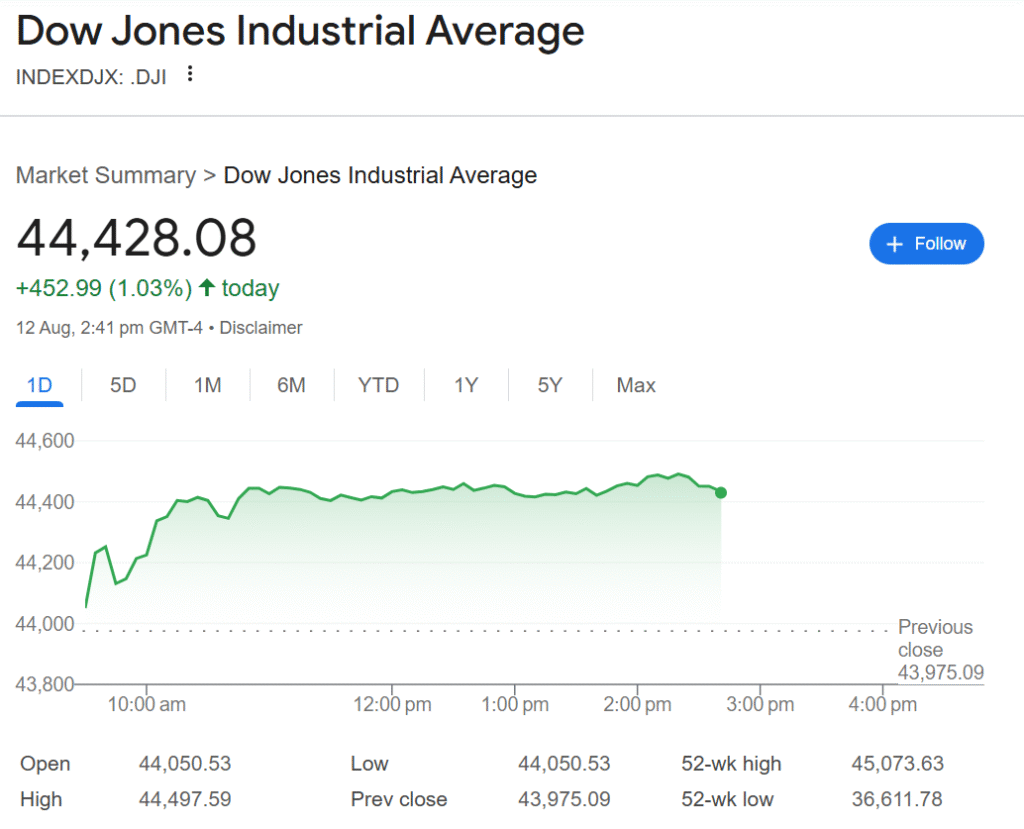

The Dow Jones Industrial Average climbed 463 points, or 1.1%, to 44,428. The S&P 500 rose 1% to 6,440, while the Nasdaq Composite jumped 1.3% to 21,656 — both notching new intraday highs.

The consumer price index increased 2.7% annually in July, just shy of the 2.8% forecast. Core CPI, which excludes food and energy, rose 3.1%, slightly above estimates. The data soothed investor concerns that President Donald Trump’s sweeping tariff policies might stoke inflation.

Traders now see a 91% chance of a rate cut in September, up from 85% before the CPI release, according to CME’s FedWatch Tool. Bets on additional cuts in October and December also rose.

“It looks like a bit of Goldilocks right now for the stock market,” said Tom Hainlin, national investment strategist at U.S. Bank Asset Management Group. “Rates kind of on a downward bias, earnings on an upward bias — that’s a pretty good environment for the broad stock market.”

Small-cap stocks led the rally, with the Russell 2000 up nearly triple the S&P 500’s gain. Circle Internet Group soared 12% after reporting a 53% year-over-year revenue increase in its first earnings report since going public.

The rally came as President Trump extended a 90-day pause on higher tariffs on Chinese goods, delaying a potential escalation until November 10. The move was welcomed by markets ahead of Thursday’s producer price index release and the Fed’s Jackson Hole symposium later this month.

The central bank’s annual gathering in Wyoming, set for August 21–23, is expected to offer clues on future policy moves. Fed Chair Jerome Powell’s remarks could be pivotal as officials weigh inflation risks against signs of labor market softness.