Investors eye trade talks and earnings reports as markets recover from Friday’s steep losses

U.S. stocks surged Monday, clawing back sharp losses from the previous session as investors weighed trade developments and upcoming earnings reports.

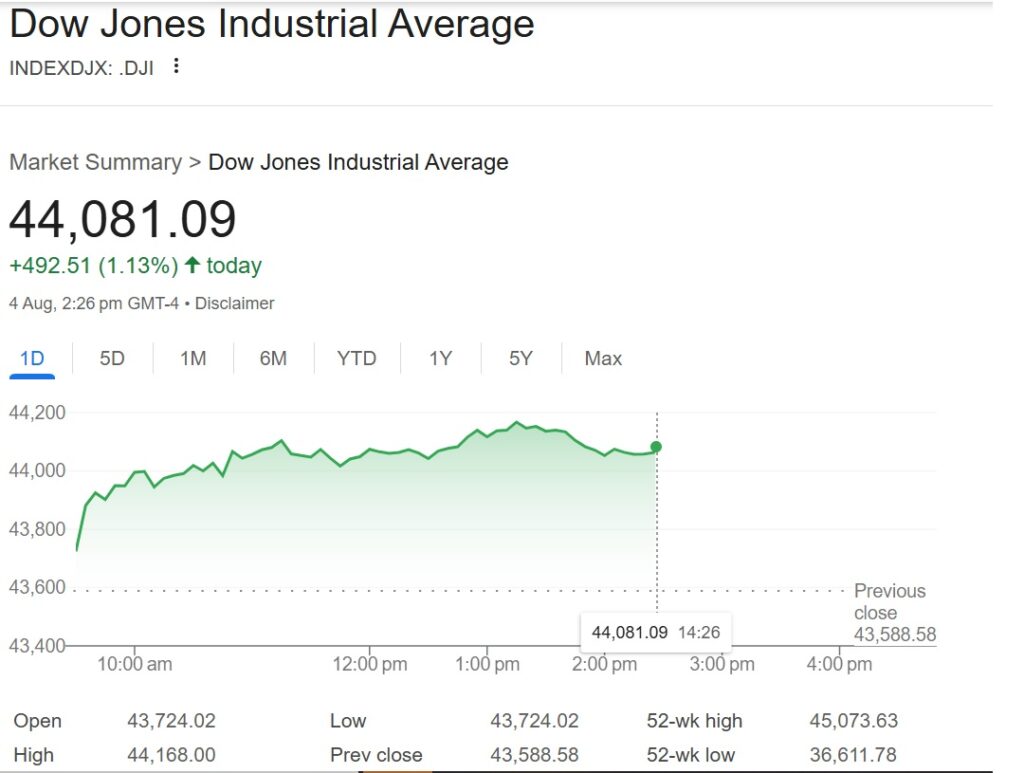

The Dow Jones Industrial Average jumped 480 points, or 1.1%, while the S&P 500 rose 1.3%. The Nasdaq Composite led gains with a 1.8% increase.

“Today is sort of a bounce-back day,” said Sam Stovall, chief investment strategist at CFRA Research. “Stocks tend to pop after a drop, so that’s what’s happening.”

Stovall cautioned that Tuesday could bring renewed selling pressure. “There could be a possibility that investors think, ‘You know what, we really need to take some money off the table to digest some of these gains,’” he said.

Markets tumbled Friday following a weaker-than-expected jobs report, which included downward revisions to May and June employment figures. Shortly after its release, President Donald Trump dismissed the head of the Bureau of Labor Statistics and said he would name a new commissioner in the coming days.

Investor sentiment was further shaken by Trump’s executive order updating tariff rates on dozens of U.S. trading partners. The revised “reciprocal” tariffs range from 10% to 41%, affecting countries from Syria to Taiwan.

With few major economic reports due this week, attention is turning to trade negotiations and corporate earnings. Senior officials from the U.S. and China met last week in Stockholm, Sweden, and Treasury Secretary Scott Bessent told CNBC that “we have the makings of a deal.”

Earnings season continues with Palantir Technologies set to report after Monday’s close and Advanced Micro Devices (AMD) scheduled to release results Tuesday.

Despite Monday’s rally, August remains historically weak for equities. According to the Stock Trader’s Almanac, it is the worst month for the Dow since 1988 and the second worst for both the S&P 500 and Nasdaq Composite.

Market Snapshot & Key Events

| Index/Company | Movement | Details |

|---|---|---|

| Dow Jones Industrial Avg | +480 points (+1.1%) | Rebounded after Friday’s selloff |

| S&P 500 | +1.3% | Broad-based recovery across sectors |

| Nasdaq Composite | +1.8% | Tech stocks led gains |

| Palantir Technologies | Earnings Monday | Results due after market close |

| AMD | Earnings Tuesday | Investors watching for chip sector signals |

| Trump Tariffs | Updated 10%–41% | Affects dozens of trading partners |

| BLS Leadership | Commissioner fired | Trump to name replacement this week |

| U.S.-China Trade Talks | Stockholm meeting | Officials signal progress toward a deal |

| August Market Trend | Historically weak | Worst month for Dow since 1988 |