Dow Jones rises 179 points to extend winning streak as healthcare stocks lift sentiment amid tech weakness

U.S. stocks inched to fresh highs Tuesday, as investors digested mixed corporate earnings and updates on trade policies. While the S&P 500 marked its 11th record close of the year, declines in key tech names weighed on broader sentiment.

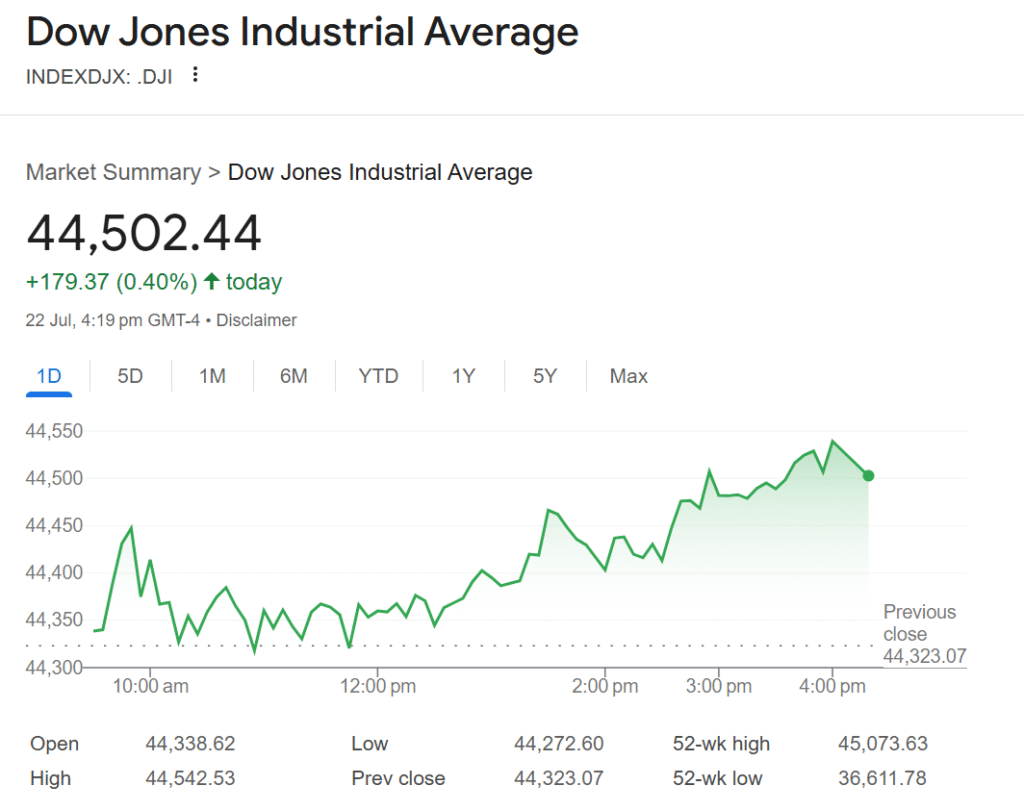

The S&P 500 added 0.06% to close at 6,309.62, narrowly surpassing Monday’s record. The Dow Jones Industrial Average rose 179.37 points, or 0.40%, to 44,502.44, while the Nasdaq Composite fell 0.39% to 20,892.68, snapping a seven-day winning streak.

Key Index Movements

| Index | Closing Value | Change | % Change |

| S&P 500 | 6,309.62 | +3.89 | +0.06% |

| Dow Jones Industrial Avg | 44,502.44 | +179.37 | +0.40% |

| Nasdaq Composite | 20,892.68 | -81.84 | -0.39% |

| Russell 2000 (Small Caps) | — | — | +0.80% |

General Motors fell 8.1% despite beating profit expectations, citing a potential $4 billion to $5 billion hit this year due to tariffs. Meanwhile, homebuilders rallied on upbeat earnings reports.

Tech stocks faltered, led by declines in Broadcom (-3%), Nvidia (-2%), and Taiwan Semiconductor (-2%), after reports that SoftBank and OpenAI’s joint $500 billion AI initiative had scaled back its near-term plans.

Lockheed Martin sank nearly 11% following a revenue miss, and Philip Morris dropped 8% after reporting below-par Q2 sales. In contrast, healthcare led gains, lifted by a strong performance from IQVIA (+18%), Amgen, and Merck.

Earnings season remains in full swing, with 88 S&P 500 companies having reported so far—82% of them beating estimates, according to FactSet.

Eyes are now on tech giants Alphabet and Tesla, slated to report Wednesday, as part of the “Magnificent Seven” cohort expected to drive earnings momentum.

On the trade front, Treasury Secretary Scott Bessent said the U.S. may extend the deadline for a China deal and plans to meet Chinese officials in Stockholm. President Donald Trump also claimed a trade agreement with the Philippines imposing a 19% tariff, though Philippine officials have yet to confirm.

“This market’s pretty stalled out,” said Jay Hatfield, CEO of Infrastructure Capital Advisors. “We are going to need very strong tech earnings to propel the market much higher.”