Earnings surprises, falling jobless claims & robust retail sales fuel market gains; PepsiCo, United Airlines lead rally

U.S. stocks advanced solidly Thursday as encouraging corporate earnings reports and robust economic data bolstered investor confidence.

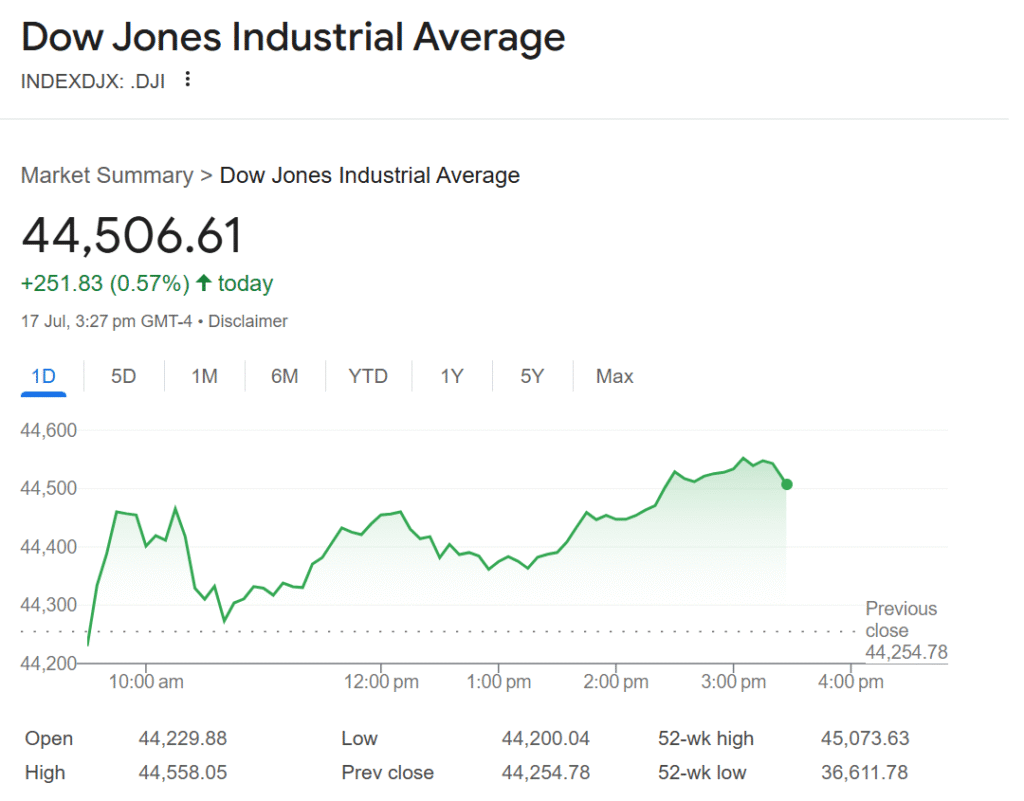

The S&P 500 rose 0.5 percent. The Dow Jones Industrial Average gained 229 points, or 0.5 percent. The technology-focused Nasdaq Composite climbed 0.8 percent.

Corporate earnings fueled significant moves in individual stocks. PepsiCo shares surged more than 5 percent after the beverage and snack giant reported quarterly results exceeding Wall Street expectations. United Airlines also saw strong gains, climbing 6 percent after surpassing earnings estimates.

The positive earnings trend extended broadly. With approximately 50 S&P 500 companies having reported results for the latest quarter so far, 88 percent have beaten analysts’ forecasts, according to data from FactSet.

Supporting the market’s upward move, key economic indicators released Thursday pointed to underlying economic strength:

- The Labor Department reported initial jobless claims for the week ending July 12 fell to 221,000, a decrease of 7,000 from the prior week.

- Separately, the U.S. Census Bureau reported retail sales increased 0.6 percent in June compared to May, significantly exceeding the Dow Jones consensus estimate of 0.2 percent growth.

“A reassuring retail sales result comes at the perfect time as earnings season kicks into gear,” said Bret Kenwell, U.S. investment analyst at eToro. “If earnings are more upbeat than expected and if management continues to tell a reassuring story about consumer spending, stocks could react favorably — even after a rally to record highs that some investors may view as overextended. At the end of the day, consumers are the backbone of the U.S. economy.”

Thursday’s gains followed a volatile session on Wednesday driven by political uncertainty. Stocks initially fell after a White House official suggested President Donald Trump “likely will soon” fire Federal Reserve Chairman Jerome Powell. Markets recovered most losses later in the day after Trump publicly denied the reports, stating he was “not planning on doing it,” though he added he does not “rule out anything.”

For the week so far, the S&P 500 is up 0.6 percent, the Dow has gained 0.3 percent, and the Nasdaq has jumped 1.5 percent.

European markets also closed higher Thursday, lifted by a wave of positive earnings reports from companies across the region.