Dow Jones add 88 points; CPI, bank earnings in focus

U.S. stocks closed modestly higher on Monday, with the Nasdaq Composite sealing a fresh record, as investors looked past renewed global trade tensions toward upcoming inflation data and corporate earnings.

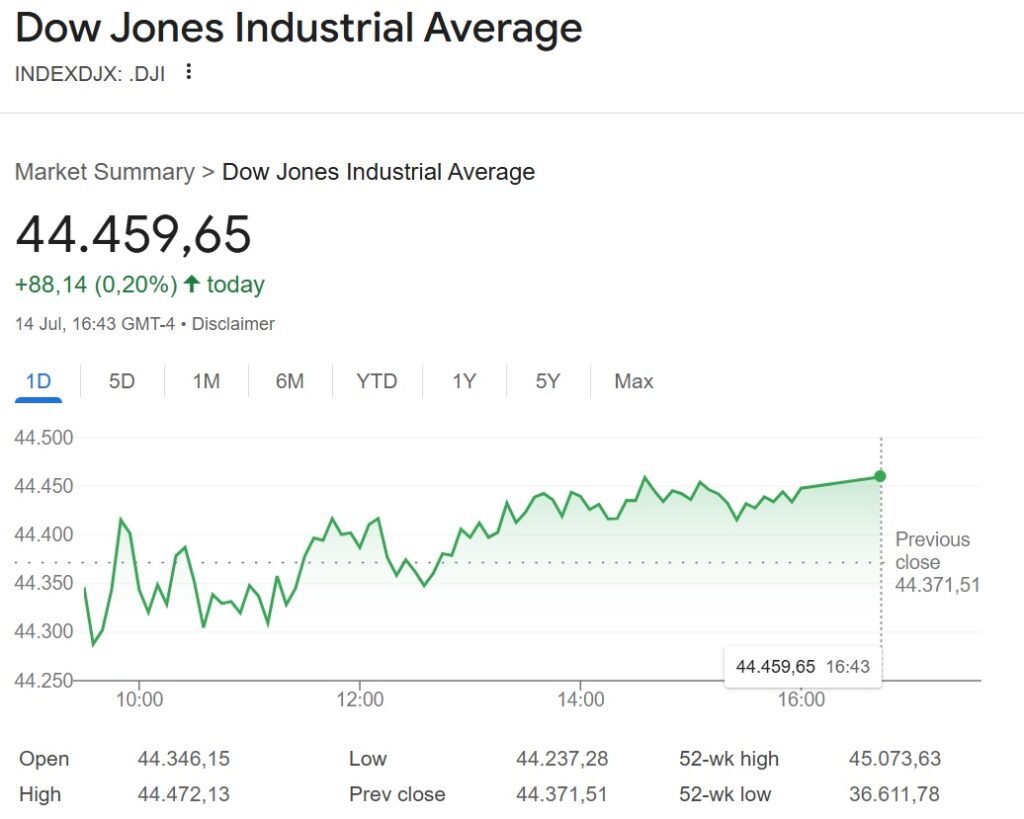

The tech-heavy Nasdaq (IXIC) rose 0.27% to 20,640.33, its fourth consecutive all-time high. The S&P 500 (GSPC) gained 0.14% to 6,268.56, and the Dow Jones Industrial Average (DJI) climbed 0.20% to 44,459.65. Markets shrugged off weekend threats from former President Donald Trump to impose 30% tariffs on the European Union and Mexico starting August 1.

Table: Key Index Performance

| Index | Closing Level | Change | % Change |

| Nasdaq (IXIC) | 20,640.33 | +55.49 | +0.27% |

| S&P 500 (GSPC) | 6,268.56 | +8.78 | +0.14% |

| Dow Jones (DJI) | 44,459.65 | +88.14 | +0.20% |

Bitcoin (BTC-USD) briefly surged to $123,000—a first—amid “Crypto Week” legislative hearings in Congress before retreating below $120,000. Crypto-linked stocks rallied as the House weighed three digital-asset bills.

Trade, Inflation, and Earnings in Focus

Trump’s tariff announcement initially dampened risk appetite, but optimism that rates could be renegotiated buoyed markets. EU and Mexican officials signaled efforts to secure lower tariffs through new deals.

Upcoming Catalysts:

- June CPI Report (July 16): Crucial for assessing tariff-driven inflation ahead of the Fed’s rate decision (July 31).

- Q2 Earnings Season: Major banks (JPMorgan, Wells Fargo) report from Tuesday.

- Geopolitical Tensions: Trump threatened 100% “secondary” tariffs on Russia and pledged weapons for Ukraine.

Table: Critical Events This Week

| Date | Event | Market Impact |

| July 16 | June CPI Data | Fed rate-hike clues |

| July 16 | Bank Earnings Begin | Financial sector health |

| Aug. 1 | EU/Mexico Tariffs Deadline | Global trade reshuffle risk |

Glen Smith, CIO of GDS Wealth Management, noted: “The question is whether solid earnings can overshadow lingering tariff risks. So far, resilience prevails.”

Other Developments

- Fed Tensions: Trump advisors explored legal grounds to dismiss Fed Chair Jerome Powell, criticizing rate policy.

- Regulatory Shift: Wells Fargo (WFC) reports post-regulatory restrictions lift, drawing investor interest.

- Market Context: Stocks rebounded from last week’s dip, holding near record highs.