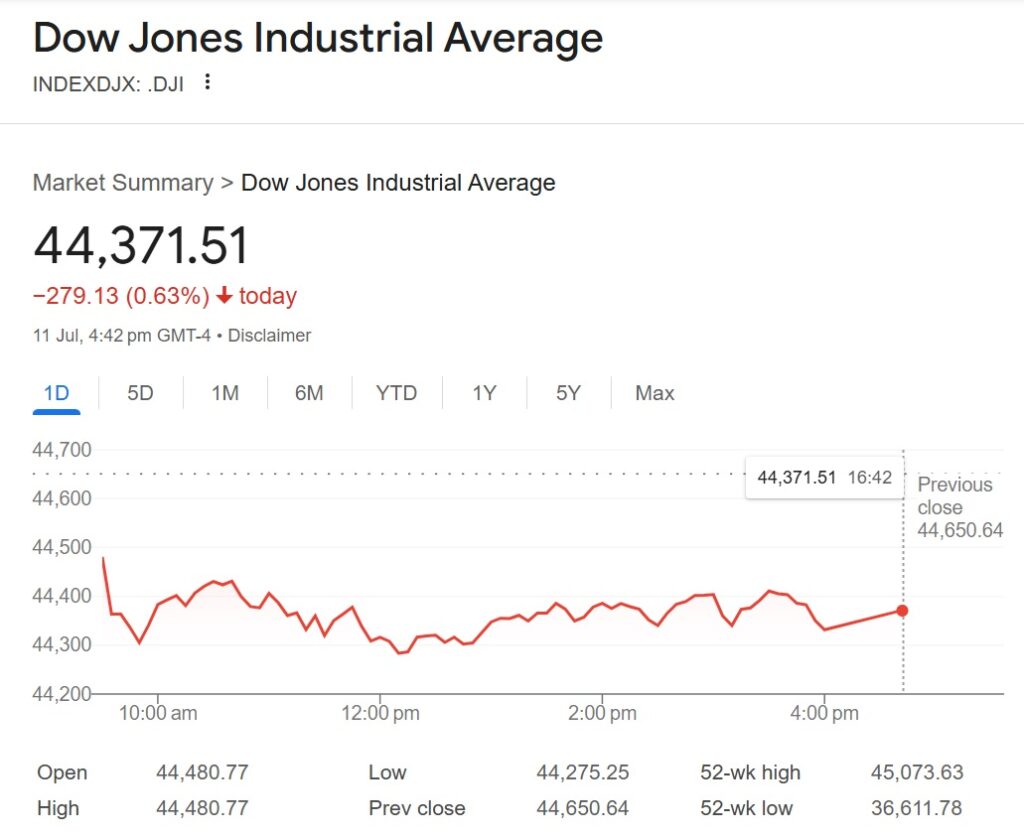

Dow Jones ends down 0.6% on Trump’s Canada tariff, broader trade threats loom

U.S. stocks declined Friday, giving back gains from the previous session after President Donald Trump escalated trade tensions with sweeping new tariff threats. The losses followed a record-setting day for the S&P 500 and came as investors digested concerns about international trade and looming economic data.

All three major indexes closed lower as traders reacted to a 35% tariff on Canadian goods announced late Thursday and Trump’s suggestion of broader tariffs on other countries.

“If Canada works with me to stop the flow of fentanyl, we will, perhaps, consider an adjustment to this letter,” Trump wrote in a post on Truth Social. He later told NBC News he planned blanket tariffs ranging from 15% to 20%, surpassing the current 10% rate.

💼 Market Performance: Friday, July 11

| Index | Closing Value | Change | % Change |

| Dow Jones Industrial | 44,371.51 | -279.13 pts | -0.63% |

| S&P 500 | 6,259.75 | -20.77 pts | -0.33% |

| Nasdaq Composite | 20,585.53 | -45.29 pts | -0.22% |

📊 Weekly Performance Snapshot

| Index | Weekly Change |

| Dow Jones Industrial | -1.00% |

| S&P 500 | -0.30% |

| Nasdaq Composite | -0.10% |

Trump’s aggressive trade posture added pressure to markets that had shown resilience earlier in the week. Thursday’s record for the S&P 500, up 0.3%, and a modest gain for the Nasdaq came as investors brushed off tariffs on imported copper and Brazilian goods.

However, Friday’s sentiment shifted as investors awaited potential European Union tariff updates that never materialized during market hours. The ambiguity weighed on confidence heading into the weekend.

“This has been a week thus far where the rising rhetoric around trade didn’t adversely affect markets,” said Art Hogan, chief market strategist at B. Riley Wealth Management. “But the order of magnitude with one of our most important trade partners that just got dumped in our laps overnight was an eye-opener.”

Looking ahead, traders are bracing for second-quarter earnings reports and critical inflation data, expected to test market stability next week.