Dow Jones rises over 200 points as tariff anxiety eases and tech stocks rally

U.S. stocks rallied Wednesday, led by strength in technology shares as Nvidia briefly hit a historic $4 trillion market valuation and investors absorbed fresh tariff news from President Donald Trump.

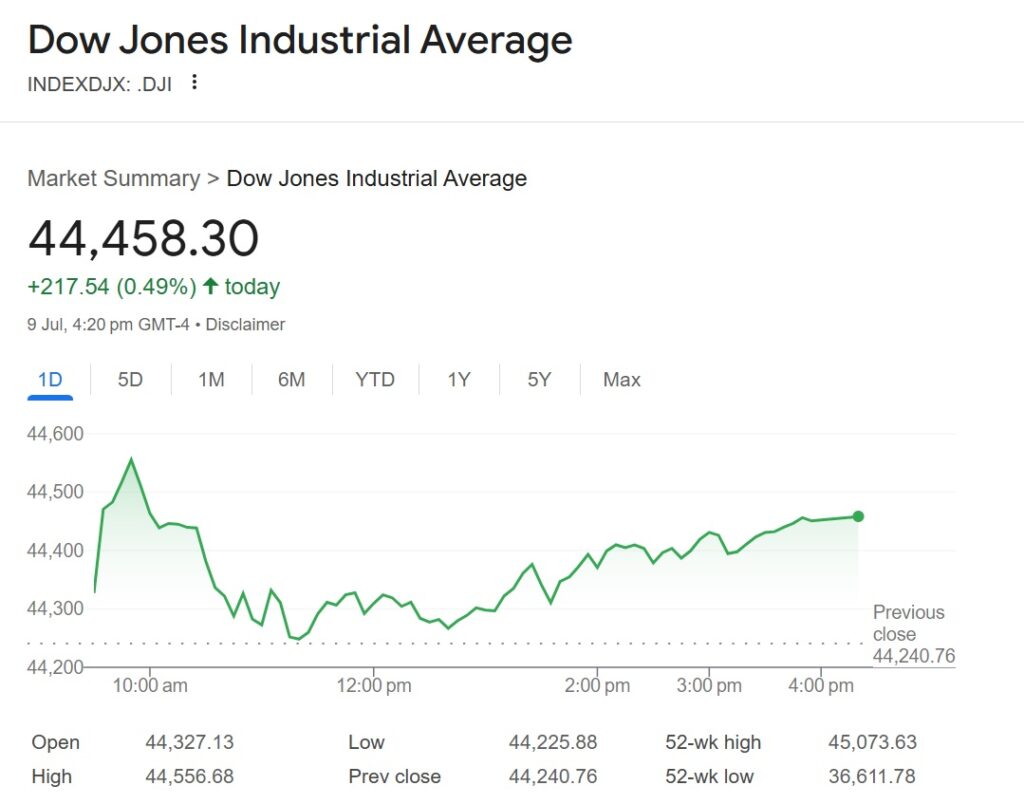

The S&P 500 rose 0.61% to close at 6,263.26, while the Nasdaq Composite gained 0.94% for a record finish of 20,611.34. The Dow Jones Industrial Average added 217.54 points, or 0.49%, ending the day at 44,458.30.

Major Index Performance

| Index | Change | % Change | Closing Value |

| S&P 500 | +38.02 | +0.61% | 6,263.26 |

| Nasdaq Composite | +192.18 | +0.94% | 20,611.34 |

| Dow Jones Industrial | +217.54 | +0.49% | 44,458.30 |

Nvidia (NVDA) led the surge in tech, rising 1.8% and briefly surpassing a $4 trillion market cap—becoming the first company to hit that mark. Other tech giants joined the rally, including Alphabet, Microsoft, and Meta Platforms, as enthusiasm for artificial intelligence continued to drive investor appetite.

Tech Movers

| Company | Ticker | % Change |

| Nvidia | NVDA | +1.8% |

| Broadcom | AVGO | +2.0% |

| Meta Platforms | META | +2.0% |

| Amazon | AMZN | +1.2% |

| Alphabet | GOOG | +1.3% |

| Microsoft | MSFT | +1.1% |

| Apple | AAPL | +0.4% |

| Tesla | TSLA | −0.3% |

AES Corp. (AES) posted the strongest performance in the S&P 500, soaring 19% after Bloomberg reported the renewable energy firm was exploring strategic options, including a potential sale.

Bitcoin hovered near its all-time high, climbing to $111,200 from an overnight low of $108,300. Shares of Strategy (MSTR) and Coinbase Global (COIN), both major crypto players, each rose more than 4%.

Market Metrics

| Asset/Class | Value | Change |

| Bitcoin | $111,200 | ↑ from $108,300 |

| Gold (futures) | $3,325/oz | +0.2% |

| WTI Crude Oil | $68.30 | −0.1% |

| 10-Year Treasury Yield | 4.34% | ↓ from 4.42% |

| U.S. Dollar Index | 97.52 | Flat |

Trump’s Tariff Push Continues

Trump intensified tariff pressures this week, sending letters to leaders of at least 20 countries—including Japan, South Korea, the Philippines, and Iraq—outlining new tariffs ranging from 20% to 40%, set to begin Aug. 1. He also announced a 50% duty on copper imports and floated up to 200% tariffs on pharmaceuticals, though he said enforcement may take up to 18 months.

Despite mounting trade tensions, markets appeared resilient.

“The market is just shrugging these tariff threats off and presuming that there is room for deals and negotiations,” said Ross Mayfield, investment strategist at Baird. “The extension of the deadlines to Aug. 1 is an admission that there’s a deal-making appetite—and the market is clearly going to run with that until proven otherwise.”