Bank stocks climb, renewable energy surges as trade optimism and U.S. job data fuel European market gains

LONDON: European stocks advanced Thursday as investors welcomed unexpectedly strong U.S. jobs data, which bolstered global equities and lifted bank shares across the region. Hopes for a trade accord between the European Union and the United States also contributed to market optimism.

The pan-European STOXX 600 index rose 0.5%, following a 0.9% gain on Wall Street’s S&P 500. Germany’s DAX climbed 0.6%, while France’s CAC 40 edged up 0.2%.

U.S. nonfarm payrolls added 147,000 jobs in June, exceeding economists’ expectations of 110,000, with the unemployment rate dipping to 4.1%. Analysts interpreted the data as a sign of resilience in the world’s largest economy.

“Today’s good news should be treated as such by the markets, with equities rising despite the accompanying pickup in interest rates,” said Jeff Schulze, strategist at ClearBridge Investments.

Expectations for Federal Reserve rate cuts narrowed following the report, with traders now anticipating two quarter-point reductions by yearend, down from three prior to the data release.

Major Index Moves

| Index | Change |

| STOXX 600 | +0.5% |

| S&P 500 (U.S.) | +0.9% |

| DAX (Germany) | +0.6% |

| CAC 40 (France) | +0.2% |

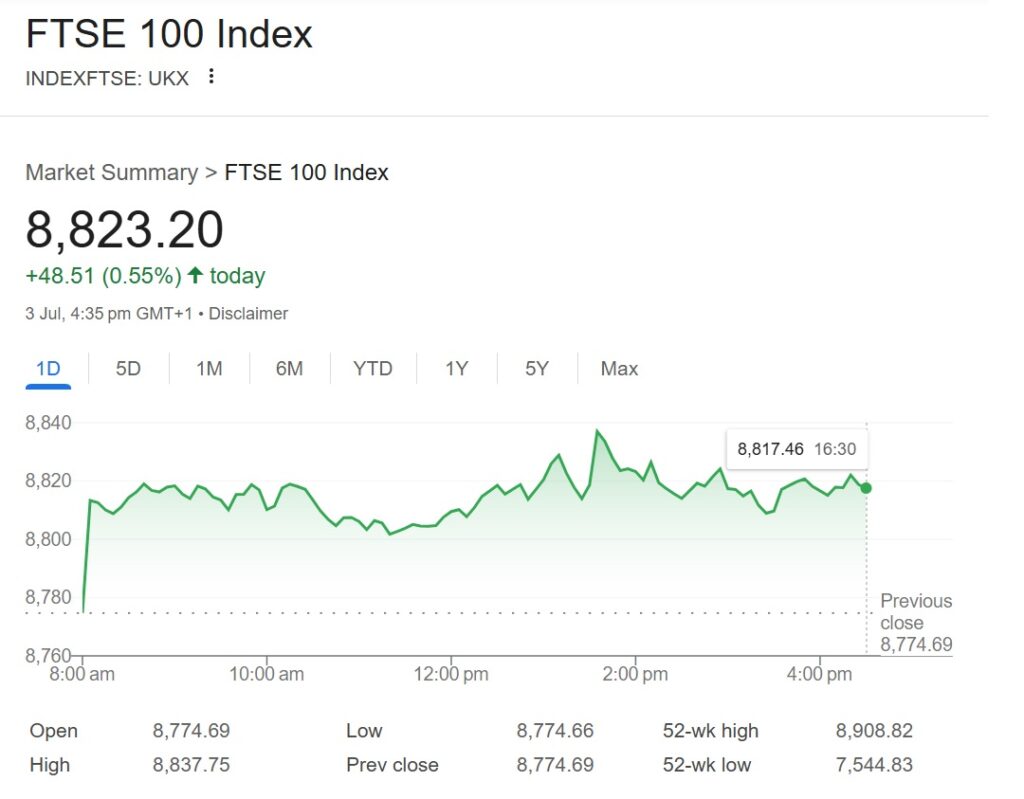

| FTSE 100 (UK) | +0.6% |

| FTMC (UK Midcaps) | +1.2% |

Bank shares led gains in Europe, with NatWest and Lloyds climbing more than 3% each. The STOXX Banks index was Thursday’s top sectoral performer.

Currency Movement

| Currency | Against USD | Change |

| Euro | ↓ | -0.6% |

| British Pound | ↓ | -0.3% |

Political reassurance helped steady British assets. Prime Minister Keir Starmer’s office publicly backed Finance Minister Rachel Reeves, following an emotional moment in Parliament.

Elsewhere, the U.S. reached a trade agreement with Vietnam ahead of next week’s tariff deadline announced by President Donald Trump. European Commission President Ursula von der Leyen confirmed talks with the U.S. were progressing toward a deal in principle.

Market sentiment was further buoyed by easing U.S.-China trade restrictions. Siemens AG rose 0.8%, briefly jumping 3% before paring gains.

Renewable Energy and Corporate Highlights

- Wind turbine maker Vestas surged nearly 7%, amid optimism that a U.S. spending bill could benefit clean energy.

- French company Pluxee added 4.4% after posting an 11.1% organic rise in quarterly revenue.

Meanwhile, minutes from the European Central Bank’s latest policy meeting confirmed a rate cut designed to counter tightening monetary conditions amid global uncertainty.