Dow, Nasdaq, and S&P 500 rebound as oil prices dip and investors eye July Fed rate cut

Global markets on Monday appeared to shrug off rising tensions in the Middle East after the U.S. joined Israel in launching airstrikes on Iranian nuclear facilities over the weekend. Despite fears of regional escalation, both stock and commodity markets stabilized, buoyed by falling oil prices and growing speculation that the Federal Reserve might move to cut interest rates as early as July.

Geopolitical Flashpoint Meets Market Resilience

The latest round of hostilities, marked by President Trump’s announcement of “total obliteration” of three Iranian enrichment sites, had investors on edge as trading began. Iran’s parliament voted to support closing the Strait of Hormuz—a vital channel for 20% of global oil flows—but no official action has followed.

Iran’s measured retaliation—missiles aimed at a U.S. base in Qatar with no casualties—was interpreted by analysts as a calibrated response, aimed more at signaling resolve than prompting further escalation.

Oil Prices Recoil After Overnight Spike

Oil briefly surged 4% on Sunday night before retreating sharply once it became clear that full-scale retaliation was unlikely. Brent crude futures fell nearly 7% by Monday’s close.

Oil Market Snapshot — June 23, 2025

| Crude Type | Price (USD) | Change (%) |

|---|---|---|

| Brent (BZ=F) | 71.48 | -7.0% |

| WTI (CL=F) | 68.51 | -6.7% |

| U.S. Benchmark Crude | 73.69 | -0.2% |

Despite Monday’s dip, oil prices remain elevated compared to early June when WTI hovered near $68.

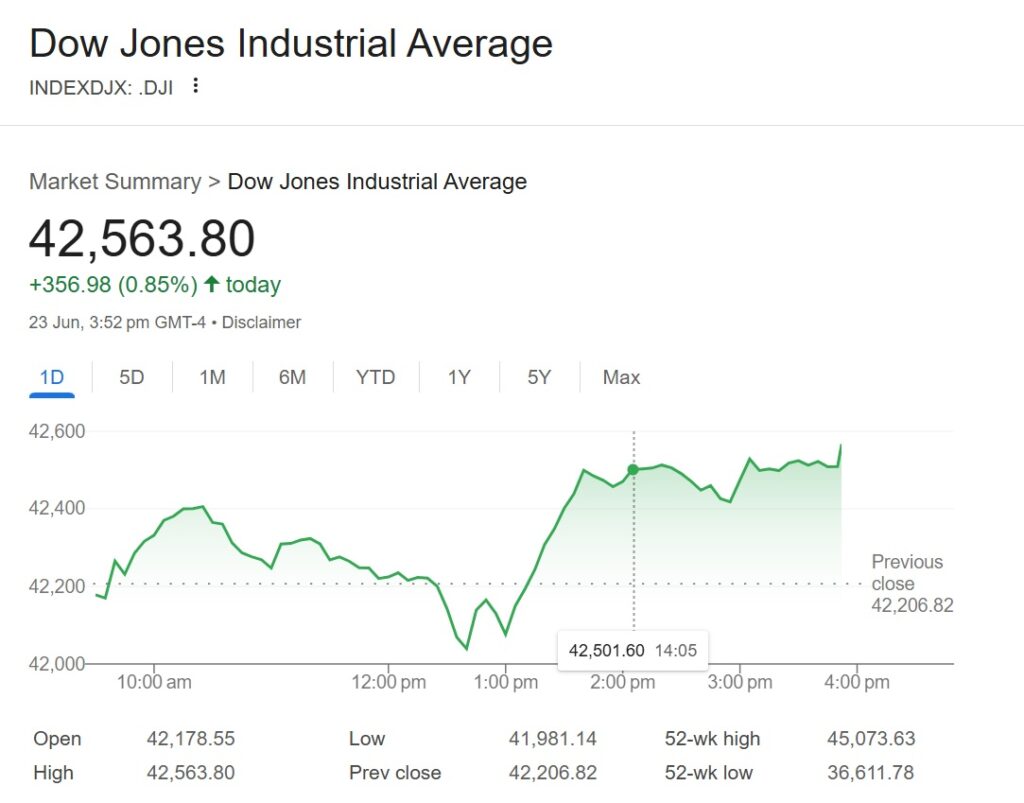

Stocks Rebound on Rate-Cut Hopes and Tech Gains

Markets reversed early losses after Federal Reserve Governor Michelle Bowman voiced support for a potential rate cut by July, citing global instability and subdued inflation.

Tesla helped power the rally with a near-10% surge after launching its much-anticipated robotaxi service in Austin, Texas. Defense stocks like Boeing and Northrop Grumman also advanced amid expectations of increased defense spending.

Major Indexes — June 23, 2025 (Midday EDT)

| Index | Level | Change (%) |

|---|---|---|

| Dow Jones (DJI) | 42,310 | +0.23% |

| S&P 500 (GSPC) | — | +0.48% |

| Nasdaq (IXIC) | 19,534.85 | +0.56% |

Top Movers

| Company | Ticker | Move (%) | Catalyst |

|---|---|---|---|

| Tesla | TSLA | +9.5% | Robotaxi rollout in Austin |

| Northern Trust | NTRS | +8.0% | Merger speculation with BNY Mellon |

| Northrop Grumman | NOC | +1.8% | Iran airstrike reaction |

| Boeing | BA | +1.6% | Defense sector tailwinds |

| Hims & Hers | HIMS | -28% | Failed drug partnership |

| Wolfspeed | WOLF | -30% | Bankruptcy announcement |

Crypto and Commodities

Bitcoin and Ether gained as investors sought out alternative assets amid global uncertainty, while gold edged slightly higher.

| Asset | Price (USD) | Change (%) |

|---|---|---|

| Bitcoin | 67,120 | +2.3% |

| Ether | 3,320 | +3.3% |

| Gold | 2,365 | +0.4% |

Looking Ahead: Fragile Calm or Calm Before the Storm?

While markets have found a footing—for now—analysts warn the relative calm could be fleeting. Iran’s leadership has yet to articulate a definitive path forward, and any disruption to shipping through the Strait of Hormuz could send oil spiking again, reigniting inflation and derailing monetary easing efforts.

The coming weeks may prove pivotal, not just for geopolitics, but for the global economy’s trajectory through the second half of 2025.