Fed Rate Cut Speculation and Iran Diplomacy to Dictate Dow Jones Momentum Next Week

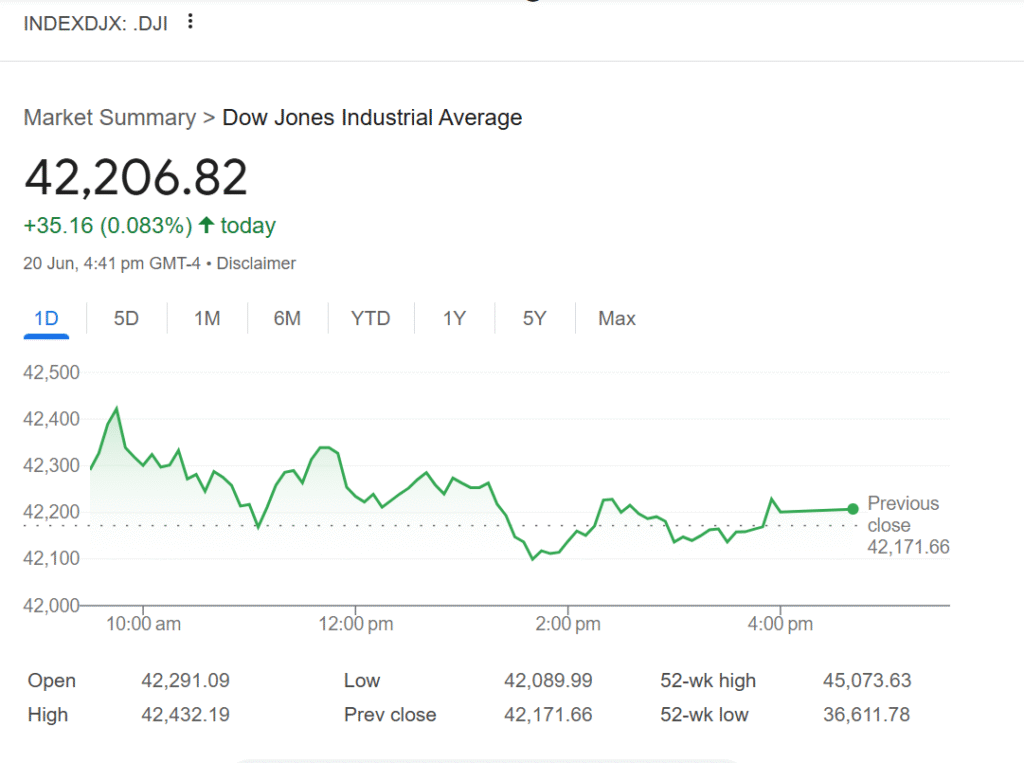

The Dow Jones Industrial Average (DJI) inched upward Friday, gaining 0.1% as easing Middle East tensions and renewed hopes for Federal Reserve rate cuts provided cautious relief to investors. The blue-chip index narrowly avoided a weekly loss, closing the holiday-shortened week up less than 0.1%.

Geopolitical Calm Supports Market Sentiment

The White House announced late Thursday that former President Donald Trump would delay a decision on potential military action against Iran for at least two weeks, easing fears of an immediate escalation. European diplomats also engaged in talks with Iranian officials, aiming to revive stalled nuclear negotiations.

The Dow, which had wobbled earlier in the week on geopolitical uncertainty, stabilized as oil prices retreated. Brent crude fell 2.3% to $77.01 a barrel, relieving some inflation concerns for energy-sensitive industrials.

Fed Signals Keep Rate Cut Hopes Alive

Federal Reserve Governor Christopher Waller bolstered market optimism Friday by suggesting that interest rate cuts could begin as early as July, citing manageable inflation risks despite new tariffs. His remarks helped offset hawkish tones from Chair Jerome Powell earlier in the week.

| Index | Friday Close | Weekly Change |

| Dow Jones Industrial | +0.1% | +<0.1% |

| S&P 500 | -0.2% | -0.2% |

| Nasdaq Composite | -0.5% | +0.2% |

Traders now price in a 35% chance of a July rate cut, per CME Group data, though September remains the more likely timing.

Sector Performance: Industrials Lead, Tech Lags

- Industrials (+0.4%) and Financials (+0.3%) supported the Dow’s gains.

- Tech stocks lagged, with the Nasdaq falling 0.5% amid U.S.-China trade concerns.

- Semiconductor stocks dipped after reports that the U.S. may revoke export waivers for firms supplying China.

Key Data and Events Ahead

- Fed Speeches: More commentary expected next week, shaping rate cut expectations.

- Economic Indicators: Investors await PMI and consumer sentiment data.

- Iran Diplomacy: Further talks could influence oil prices and market stability.

Market Snapshot

| Asset | Price/Level | Change |

| Dow Jones Industrial | 39,150 | +0.1% |

| 10-Year Treasury Yield | 4.374% | -0.02% |

| Brent Crude | $77.01 | -2.3% |

Outlook

While the Dow managed a slight gain, broader market movements reflect lingering caution. Geopolitical risks and Fed policy remain key drivers—any escalation with Iran or shift in rate expectations could dictate near-term direction.

Why It Matters

- Dow resilience suggests investors see limited near-term economic disruption.

- Fed uncertainty keeps markets on edge, but Waller’s comments offer relief.

- Next week’s focus: More Fed signals, Iran developments, and economic data.