Major Indexes Drop Amid Geopolitical Uncertainty

U.S. stocks tumbled Tuesday afternoon as escalating tensions between Israel and Iran fueled fears of deeper U.S. involvement in the conflict, rattling investor confidence.

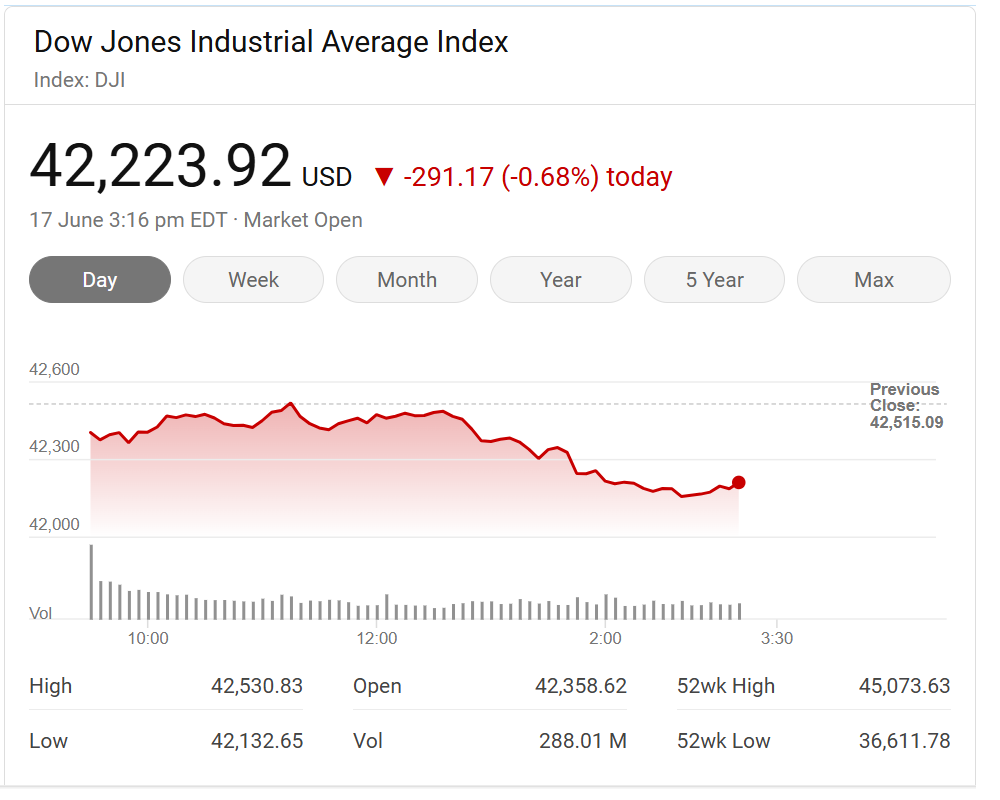

The Dow Jones Industrial Average (DJI) plunged more than 300 points, or 0.8%, to 42,190 by 2:10 p.m. Eastern time, hovering near its session low. The S&P 500 (GSPC) slid 0.9%, while the Nasdaq Composite (IXIC) dropped nearly 1%, according to FactSet data.

The sell-off accelerated after former President Donald Trump escalated his rhetoric against Iran in a Truth Social post, warning of dwindling U.S. patience.

“We know where [Iran’s leader] is hiding. He is an easy target, but is safe there — We are not going to take him out (kill!), at least not for now,” Trump wrote. “But we don’t want missiles shot at civilians, or American soldiers. Our patience is wearing thin.”

Oil Prices Surge as Conflict Fears Mount

Energy markets reacted sharply to the geopolitical turmoil, with Brent crude futures (BZ=F) climbing over 3% to settle above $76.50 a barrel. West Texas Intermediate (CL=F), the U.S. benchmark, also rose past $75 per barrel.

Reports from Axios indicated that the Biden administration is considering military strikes against Iran, raising concerns about a broader regional conflict.

| Market Snapshot | Price/Points | Change | % Change |

| Dow Jones | 42,190 | -300 | -0.8% |

| S&P 500 | 5,230 | -45 | -0.9% |

| Nasdaq | 16,450 | -160 | -1.0% |

| Brent Crude | $76.52 | +$2.35 | +3.2% |

| WTI Crude | $75.10 | +$2.20 | +3.0% |

Retail Sales Disappoint, Fed Meeting in Focus

Commerce Department reported that U.S. retail sales fell 0.9% in May, worse than economists’ expectations. The decline suggests consumers are pulling back after a pre-tariff spending surge.

Investors are now turning their attention to the Federal Reserve’s two-day policy meeting, which begins Tuesday. While the central bank is widely expected to hold interest rates steady in its Wednesday decision, traders will scrutinize policymakers’ outlook for potential rate cuts in 2025.

Trade Policy Concerns Linger

Wall Street is also grappling with uncertainty over Trump’s trade policies, as the G7 summit saw U.S. officials push for new trade agreements. On Monday, Trump and U.K. Prime Minister Keir Starmer finalized a U.S.-U.K. trade pact initially agreed upon in May. However, negotiations with other nations remain stalled.

Stocks to Watch

Despite the broader downturn, several stocks showed resilience:

- Goldman Sachs (GS): Breaking out past a 620.79 buy point in a cup-with-handle base, the financial giant remains a top Dow Jones performer. Shares dipped slightly Tuesday but held above the entry level.

- Brinker International (EAT): The parent company of Chili’s and Maggiano’s is in a buy range above 177.91.

- Credo Technology (CRDO): Nearing an 80.99 entry point after strong recent gains.

- Sportradar (SRAD): Approaching a 25.85 cup-base entry, up 0.5% midday.

Outlook

While markets had initially shown resilience to Middle East tensions, the latest developments suggest investor sentiment remains fragile. With geopolitical risks, trade policy shifts, and Fed uncertainty in play, traders are bracing for further volatility.