Baselayer, a B2B platform specializing in proprietary Graph AI technology, has raised $6.5 million seed funding. The company, which boasts a seasoned team of compliance and machine learning experts, has made a remarkable entry by securing nearly 30 customers within six months, including Rho and a leading loan infrastructure system, thereby extending its potential reach to over 25 million business accounts.

The seed funding round, which was five times oversubscribed, saw contributions from Torch Capital, Afore Capital, Founder Collective, Picus Capital, Gilgamesh Ventures, and several prominent financial industry executives.

Notably, Eric Woodward, the former President of Early Warning Services, and Jason Mikula, alongside executives from Stripe, Brex, Valley Bank, Airbase, and 15 other fintech founders, were part of this investment wave. This overwhelming interest comes at a time when fintech funding has plummeted to a seven-year low in Q1 2024, highlighting the market’s dire need for innovative solutions to tackle the evolving challenges of fraud and streamline banking services for small businesses.

The banking sector has historically struggled with the verification of small businesses during Know Your Business (KYB) reviews, often resulting in protracted manual processes. With fraud strategies becoming more sophisticated and prevalent, costing global banks a staggering $500 billion in 2023, the need for efficient verification systems has never been more pressing.

Jonathan Awad, CEO and Co-Founder of Baselayer, emphasized the critical nature of this issue, stating, “For a new or small business, the prolonged wait for a bank account can be crippling. As fraud becomes more advanced, it’s increasingly challenging for banks to verify the legitimacy of small or new companies. We experienced this issue firsthand and responded by creating a unique solution that grants banks, lenders, and payment companies on our platform access to unparalleled fraud sharing on businesses.”

Awad, along with Co-Founder and CTO Timothy Hyde, experienced the difficulty of securing a business banking account amidst multiple bank failures in early 2023. Recognizing a widespread problem, they leveraged Hyde’s expertise in artificial intelligence-generated knowledge graphs to develop a solution that not only expedites the KYB process but also enhances security within the banking system.

“All consumers will ultimately be businesses,” said Eric Woodward, former President of Early Warning and creator of Zelle Risk. “This underscores the importance of banks and providers being able to quickly and accurately assess and verify the identities and risks of small businesses at scale. While there have been tremendous innovations in consumer verifications, there has not been a comparable solution in the market to secure and simplify the KYB process, which Baselayer is now uniquely providing.”

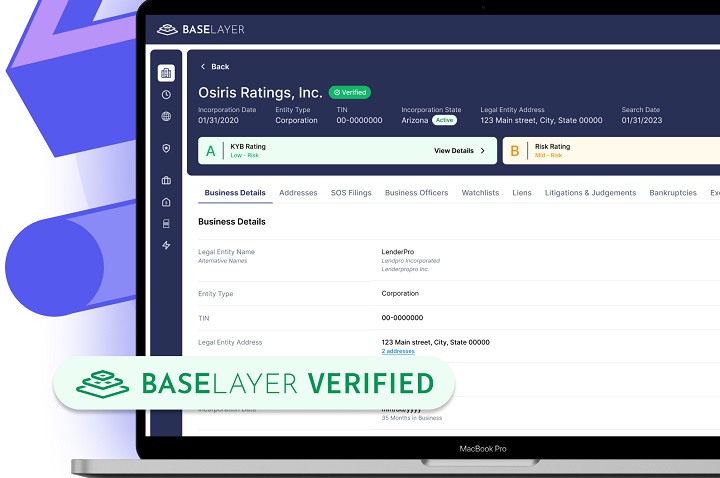

Baselayer’s innovative approach addresses the critical issue of data sharing among financial institutions, a concern recently highlighted by the U.S. Treasury Department. The platform’s infrastructure is poised to outperform legacy credit bureaus by pooling data and facilitating real-time alerts. With the capability to distinguish between legitimate and fraudulent patterns, Baselayer enables financial institutions and government agencies to verify and assess the risk of new business customers swiftly.

Since its launch, Baselayer has integrated its services with a diverse range of clients, from traditional banking providers to small business fintechs. Its impact is evident in one of the top-five loan infrastructure systems, managing loans for over 25 million accounts across nearly a thousand banks and lenders. The company’s rapid growth and integration underscore its potential to transform the landscape of financial services and fraud prevention.

“Working with Baselayer has been a game changer for us,” said George Remennik, Acting Chief Compliance Officer, Rho. “Baselayer helps us accurately verify business applicants and get new Rho customers up and running on our platform significantly faster, while also supporting the integrity of our world-class compliance operations.”