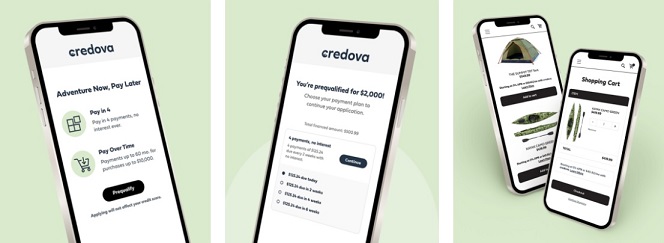

PublicSquare Holdings, Inc. (NYSE: PSQH), a marketplace for patriotic businesses and consumers, has successfully acquired Credova Holdings, Inc., a Buy Now Pay Later (BNPL) solutions provider for the shooting sports industry.

The merger, finalized on March 13, 2024, involved PublicSquare issuing approximately 2.9 million shares of Class A common stock in exchange for all outstanding shares of Credova, making it a wholly-owned subsidiary.

The transaction also saw the cancellation of Credova’s subordinated debt, replaced with PublicSquare promissory notes, convertible into PublicSquare stock. Credova’s CEO, Dusty Wunderlich, along with other key management members, have joined PublicSquare, with Wunderlich expected to serve on its board of directors.

This strategic move is expected to be immediately accretive to PublicSquare, with Credova’s historical financials indicating robust revenues and cash flow. The merger creates a comprehensive commerce stack, combining payment, financing, and marketplace services, and positions PublicSquare at the forefront of the BNPL market, particularly in the firearms and outdoor recreation sectors.

The deal, approved by both companies’ boards and Credova’s stockholders, includes non-trade agreements from former Credova stockholders and employment agreements for its management. PublicSquare will continue operations from its West Palm Beach headquarters, with Jim Giudice taking over as General Counsel.

Advisors for the transaction included Farvahar Capital, Ellenoff Grossman & Schole LLP, Nelson Mullins Riley & Scarborough LLP, and Faegre Drinker Biddle & Reath LLP.

Michael Seifert, Chairman and Chief Executive Officer of PublicSquare, commented, “The acquisition of Credova is a logical next step in the growth of the PublicSquare ecosystem. The transaction brings together two values-aligned companies and their like-minded management, merchants, and consumers into a single combined marketplace and payments platform. We also believe that we completed the transaction at an attractive valuation that unlocks significant stockholder value.

This combination solidifies the economic engine of the parallel economy and by integrating the capabilities of Credova’s Buy Now Pay Later payments universe, we open the door for both our consumers and merchants to explore sales and financing opportunities that may previously have been unavailable. This is an important milestone on our journey to owning the infrastructure foundational to the parallel economy. We are excited for our partnership with the excellence-driven Credova team and the work we will do together to ensure the Constitutional rights of every American are protected and strengthened in the Public Square.”

Dusty Wunderlich, Chief Executive Officer of Credova, commented, “The merger between Credova and PublicSquare is a declaration to the world that the parallel economy is not just thriving—it’s here to endure. By uniting our strengths, we’re accelerating Credova’s growth across various sectors and establishing Credova as the preferred payment solution for shooting sports enthusiasts.

The Credova team and I are honored to advance this movement alongside individuals who are committed to defending not only the Second Amendment but also the fundamental, inalienable rights of our merchants and customers. This partnership underscores the lasting power and potential of the parallel economy, highlighting our collective dedication to building financial infrastructure that upholds our values and protects our community. Together, we’re not merely building a business; we’re fortifying a movement poised to make a lasting impact.”

Mustang Energy signs terms to acquire Cykel AI in a share exchange deal