SINGAPORE: Singapore Exchange (SGX) has welcomed the onshore bond listings of China Development Bank (CDB), marking the first time that China onshore RMB bonds are being listed on the exchange.

China Development Bank (CDB) is the world’s largest development finance institution, and China’s largest bank specialising in medium- to long-term lending and bond issuance. Since its establishment in 1994, CDB has issued more than RMB20 trillion worth of bonds.

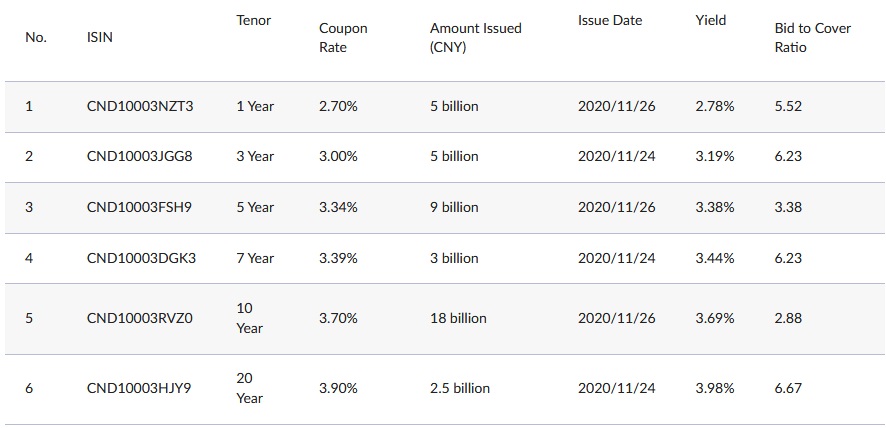

A total of six CDB fixed rate bonds across tenors of 1, 3, 5, 7, 10 and 20 years are being listed on SGX. This is a symbolic representation of CDB’s yield curve in the global bond market and underpins the continued momentum in the development and internationalisation of China’s financial markets.

Mr Loh Boon Chye, Chief Executive Officer of SGX, said, “We are delighted to welcome CDB’s onshore RMB bond on the SGX platform. Today’s listing marks another milestone in three decades of strong bilateral ties between Singapore and China, and we are excited at the tremendous opportunities to grow this partnership, bridging financial markets in China and Singapore, and jointly serving issuers and investors globally.”

A spokesperson for China Development Bank’s Treasury Bureau said, “This year marks the 30th anniversary of strong bilateral ties between China and Singapore. The listing of China Development Bank’s bonds on SGX further broadens our channels for promoting CDB bonds overseas, and supports our engagement with Singapore and global investors. It also strengthens the connectivity between the financial markets in China and Singapore, and plays a key role in the development and internationalisation of China’s financial markets.”