Merger and Acquisition (M&A) is a common practice in the corporate world to enhance a company’s growth. It is an efficient way to enter new markets, expand customer base, and acquire new technologies or resources. However, many companies still hesitate to pursue M&A due to various reasons, such as lack of expertise or fear of failure. In this blog, we will discuss how ignoring M&A can affect a company’s growth and where you need Mergers & Acquisitions Specialists.

Missed Opportunities for Growth

Ignoring M&A can lead to missed opportunities for growth. In today’s competitive market, companies need to innovate and grow faster to stay ahead of the competition. M&A provides companies with access to new technologies, resources, and customer base that can accelerate growth. Companies that do not consider M&A miss out on the chance to capitalize on market opportunities, and they might face difficulties in expanding their business. In contrast, companies that utilize M&A effectively can gain a competitive advantage and increase their market share.

Lack of Expertise

M&A is a complex process that requires expertise in various areas, such as finance, legal, and operations. Companies that lack expertise in M&A may face challenges in identifying potential targets, negotiating deals, and integrating acquired companies. In addition, companies that do not have a deep understanding of the market and industry they operate in might not be able to evaluate the potential benefits of M&A. Hence, it is important to have M&A specialists who can provide guidance and support throughout the M&A process.

Risk of Failure

M&A comes with risks, and companies that do not have the expertise to manage those risks may face failure. For example, companies that acquire a target without proper due diligence may end up with an overvalued or incompatible business. In addition, companies that do not have a clear strategy for integration might struggle to realize the expected benefits of the acquisition. Failure in M&A can lead to financial losses, damage to the company’s reputation, and loss of market share. Therefore, it is crucial to have M&A specialists who can assess the risks and develop a comprehensive integration plan.

Need for Strategic Thinking

M&A requires strategic thinking and a long-term vision. Companies that focus only on short-term goals may not be able to realize the full potential of M&A. M&A can be an effective tool for companies to achieve their strategic objectives, such as entering new markets, diversifying their product portfolio, or acquiring new technologies. Companies that have a clear strategy for M&A are more likely to succeed and create value for their shareholders. Hence, it is essential to have M&A specialists who can help companies develop a strategic plan for M&A.

Importance of Cultural Fit

M&A involves not only acquiring a business but also integrating its culture, values, and people. Companies that do not pay attention to cultural fit may face challenges in integrating the acquired business successfully. A lack of cultural fit can lead to conflicts among employees, loss of key talent, and reduced productivity. M&A specialists can help companies evaluate cultural fit and develop a plan to integrate the acquired business successfully.

Role of M&A Specialist in Corporate Transactions

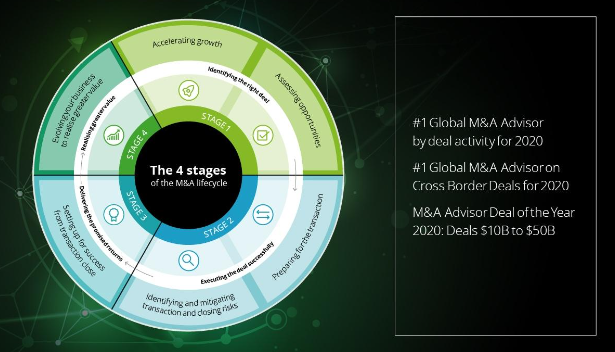

The role of a Mergers and Acquisitions (M&A) specialist is essential in corporate transactions. M&A specialists are professionals who have expertise in various areas of the M&A process, such as finance, legal, operations, and strategy. They play a critical role in guiding companies through the complex process of M&A, from identifying potential targets to integrating the acquired business successfully. In this article, we will discuss the role of M&A specialists in corporate transactions.

Identifying Potential Targets:

One of the primary roles of M&A specialists is to identify potential acquisition targets for their clients. They have the expertise to evaluate various factors, such as market trends, industry dynamics, and financial performance, to identify potential targets that align with their client’s strategic objectives. They use a variety of methods, such as market research, industry analysis, and financial modeling, to identify and evaluate potential targets.

Conducting Due Diligence:

Once potential targets are identified, M&A specialists play a crucial role in conducting due diligence. Due diligence is a comprehensive review of the target’s financial and operational performance, legal and regulatory compliance, and potential risks and liabilities. M&A specialists use their expertise in finance, legal, and operations to conduct due diligence thoroughly and identify potential risks and issues that may impact the deal.

Negotiating Deals:

M&A specialists are also responsible for negotiating deals on behalf of their clients. Sometime they conduct M&A Events for better understanding and exposure. They use their expertise in finance and legal to develop a negotiation strategy that maximizes the value for their clients. They also use their knowledge of the market and industry to identify potential issues that may impact the deal, such as regulatory hurdles or antitrust concerns, and develop a strategy to address them.

Developing Integration Plans:

M&A specialists are also responsible for developing integration plans for their clients. Integration is the process of combining the acquired business with the existing business to realize the expected benefits of the deal. M&A specialists use their expertise in operations and strategy to develop a comprehensive integration plan that addresses all aspects of the integration process, such as organizational structure, systems and processes, and culture.

Post-Merger Integration

Post-merger integration is a critical phase of the M&A process, and M&A specialists play a significant role in ensuring that the integration is successful. They help companies develop a plan for integrating the two companies, including the consolidation of operations, systems, and culture. The M&A specialist also helps the company to manage any potential conflicts that may arise during the integration process.

Valuation

M&A specialists also provide valuation services to companies that are considering buying or selling a business. They evaluate the financial situation of the target company and provide a valuation that considers the company’s assets, liabilities, and future earnings potential. The M&A specialist also assesses the market conditions and competition to determine the appropriate valuation range.

Conclusion:

Ignoring M&A can have a significant impact on a company’s growth. It can lead to missed opportunities, lack of expertise, risks of failure, lack of strategic thinking, and a lack of attention to cultural fit. Companies that want to grow and succeed in today’s competitive market need to consider M&A as a tool for growth. However, it is crucial to have M&A specialists who can guide companies throughout the M&A process and help them realize the potential benefits of M&A.